Q3 2024 Market Commentary

Did you know?

At the time of this writing, our pooled funds are lapping their fifth year of existence. We believe these funds have been a great success, both for our firm and for our clients. Returns generated since October 2019 have been strong, with double digit annualized returns for both equity strategies. These funds have provided access to our complete strategies while improving both the execution cost and access to our best ideas to even the smallest accounts. As a firm, we can deploy our strategies with rapidity and efficiency, freeing up valuable time to focus on stock selection and communications rather than implementation. We would like to thank all our clients for their confidence and support at the launch of the funds and over the ensuing period, making these funds a success.

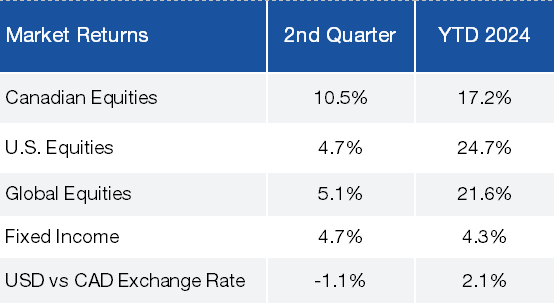

The third quarter of 2024 saw positive returns for investors across stocks, bonds, and cash, aided by lower inflation and a reduction in interest rates.

Earnings have been a key driver of the bull market, with 80% of companies beating estimates in the last quarter, compared to a five-year average of 77%.

Global equities experienced gains in the third quarter of 2024 despite some volatility, rising 5.1% in Canadian dollars. The Canadian equity market emerged as a top performer this quarter, rising over 10%.

Federal Reserve Chairman Powell expressed confidence that inflation is returning to target levels, allowing the Fed to focus on slowing labor markets. In mid-September, the Fed cut rates by 50 basis points, leading to a sharp drop in fixed income yields.

RETURNS ON MAJOR ASSET CLASSES (CAD)

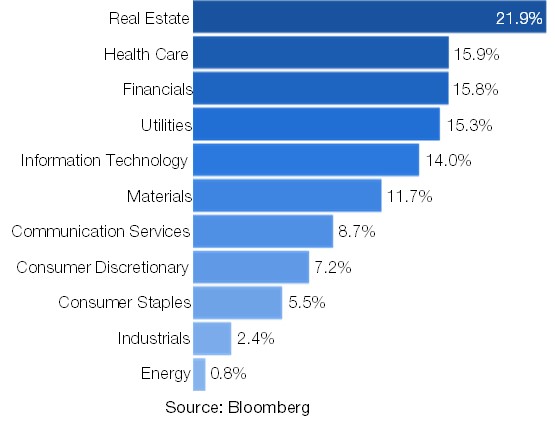

Change of Leadership

Changing expectations for interest rates significantly influenced sector performance in the third quarter. Unlike in previous quarters, marked by a very narrow leadership of the Artificial Intellegence (AI)-related stocks in the US markets, this period saw a broader range of sectors performing well. The underlying graph illustrates how this sector rotation was evident, with interest rate sensitive sectors such as real estate, utilities, and financials leading the market as rates fell.

Q3 2024 SECTOR PREFORMANCE OF THE S&P/TSX

Small-cap and international equities also performed strongly, highlighting the benefits of diversification of our strategies. Japan experienced high volatility, reaching new market highs in July before correcting sharply as the central bank raised interest rates. We also saw Chinese markets explode off the back of a planned government stimulus; the Hang Seng index was up by over 18% in light of this news.

Fixed income

The third quarter marked the beginning of rate cuts in many economies. In the US, a significant drop in non-farm payrolls and rising unemployment, along with a larger decrease in inflation, prompted the Fed to start cutting rates. Government bond yields fell sharply in anticipation, leading to a flattening yield curve. Canada’s central bank also cut rates in response to lower costs of goods and high unemployment.

These interest rate cuts and the prospect of further reductions boosted fixed income returns. In response to these rate cuts, the broad Canadian bond market rising 4.5% for the quarter. On the corporate side, investment-grade bonds performed well. In total, they have fallen by over 100 basis points for a 2-year bond in Canada.

Outlook

Although stocks are currently expensive, trading at their 90th percentile over the past 20 years, this does not necessarily indicate an imminent correction, as companies can grow into their valuations. Furthermore, valuations are quite heterogeneous. The 10 largest U.S. stocks trade at a significant premium to their historical average, while the premium is much more reasonable for the rest of the market, with value stocks and smaller capitalization stocks trading at valuations that are close to their historical averages.

While geopolitical uncertainty or economic adversity could spook investors and have an adverse impact on the stock market for some time, we remain convinced of the long-term return potential of owning the companies, with robust balance sheets and reasonable prices, held in our portfolios.

Author(s)