A volatile first quarter

Both equity and fixed income markets wrapped up a volatile first quarter that included a wild swing in interest rate expectations, a mini bank crisis culminating in the forced take-over of Credit Suisse and even an oil supply shock as OPEC unexpectedly announced production cuts.

These events caused a dramatic shift in investors’ expectations regarding interest rates, the economic outlook and more recently, the health of the banking sector. Recent moves by regulators have calmed markets and depositors, economic fundamentals should once again move to the forefront of investors’ minds.

Resilient economic activity

Overall, economic growth has remained resilient, but although inflation is receding slowly, it remains high. In the US, business activity during the quarter was mixed. Stronger retail sales and outsized job growth suggest a strong business environment. However, the manufacturing sectors continue to be in retreat while the service sector is holding up better. Housing activity in the US was also positive with New Home Sales, Existing Home Sales and Housing Starts were all up in March.

The energy shock expected from the Russia/Ukraine war was supposed to send Europe into a recession, however, that has yet to happen. Chinese growth has also surprised to the upside as evidenced by their manufacturing Purchasing managers’ Index (PMI) reaching its highest reading in a decade.

The Canadian economy performed better than expected, supported by strong exports, and continued demand. Resilience of the US has benefitted trade while the mild winter has boosted consumer spending. Immigration is expected to loosen the tight labour markets, helping companies get their labour cost under control.

Leadership shift

Despite the stress in the banking sector, stock markets advanced by 7.6 % in Canadian dollars during the quarter. The Canadian market rose by 4.6% while the US and European markets were up over 7%. Earnings growth expectations peaked in most regions in early 2022 and continue to trend lower. This has been due to in part, falling sales growth but falling margins have also played a role. Margins had been boosted by rising inflation in 2021 as pricing power improved.

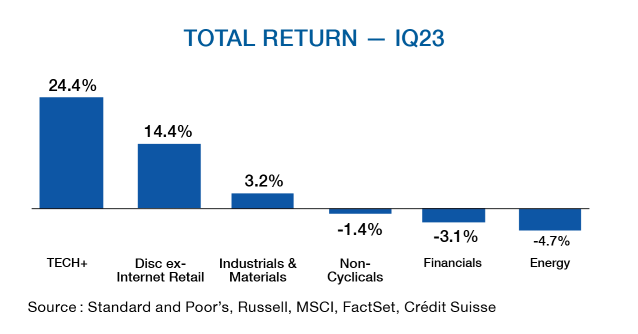

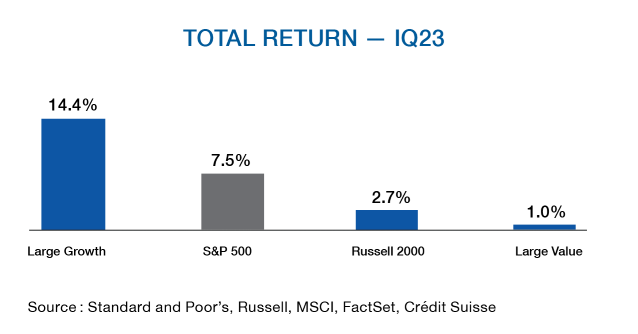

During the last 3 months, as economic and earnings expectations started to come down, leading to lower rate expectation, we saw sector and style leadership shift. Growth stocks rebounded more as interest rates expectation started to stabilize, reversing the valuation pressure experienced last year. We also saw Large Cap stocks outperform Small Cap as investors worried about smaller companies’ economic sensitivities. Beyond the typical safety found in the precious metals and miners, we also saw during the first few weeks in March Large Cap tech names (TECH+) become the “safe haven” play as investors worried about contagion from the banking crisis. This led to the Nasdaq 100 to have its best quarter since 2012, rising 20.8%. Consensus expectations call for 1Q23 growth in revenues and compression in margins.

Diversification is back

Banking turmoil pushed the rate markets lower, which until early March had braced itself for the Fed’s higher for longer rhetoric. This hawkish outlook changed on a dime and quickly priced in rate cuts as early as July as the banking crisis unfolded. Investor cofidence has increased that the cyclical peak in bonds yields have been reached allowing bonds to reassume their diversification attributes against equity market volatility.

Recession

As central banks attempt to reduce inflation with higher rates, not all corners of the economy are cooling as intended. The question on most minds, both on Wall Street and on Main Street, is whether the central banks can reach their inflation targets without triggering a recession. The Fed will only back off when it is confident that labour markets are under control, with wage inflation below the 4%. Unemployment itself is a lagging indicator and tends to continue rising once the ball gets rolling. Households respond to this rising unemployment by cutting back on consumption. Businesses trim investments.

The resulting fall in aggregated demand leads to even higher unemployment and less spending, creating a virtuous circle. The fact that there is such a lag makes it very difficult for central banks to apply the right timing and magnitude to its measures to achieve both its inflation target and a soft landing.

Outlook

While market participants brace for the recession, the quality and valuation focus of our investments and our process enable our strategies to resist cyclical downturns, as we saw last year. While earnings typically temporarily fall 15-20% during a recession, with the companies in our portfolios we expect earnings to be more resilient. With some firms, such as our automobile suppliers, who continue to talk about pent-up demand caused by the supply chain issues and strong order backlogs as well as the attractive valuations of the stocks, we have strong confidence that the portfolios will outperform despite the upcoming uncertainty.

Author(s)