Our portfolios fared much better during a challenging year

Markets: a challenging year

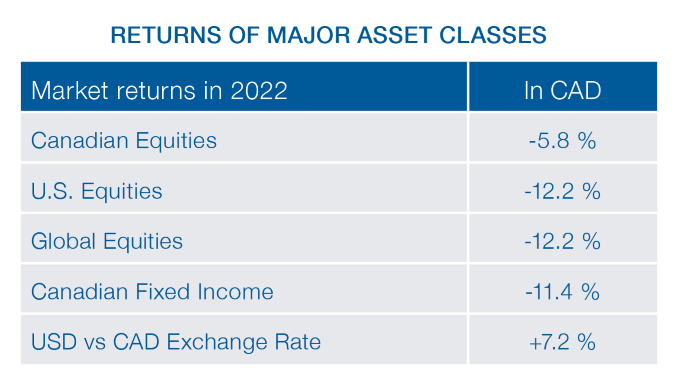

2022 has been financially difficult on many fronts. First, the cost of living has soared, with inflation reaching around 7% in North America and more than 10% in Europe, resulting in an equivalent reduction of purchasing power for consumers. At the same time, in 2022, a typical balanced portfolio for a Canadian investor declined by about 10 per cent, the worst annual decline in value since 2008. Moreover, this was the first time since 1974 that both stocks and bonds fell during the same calendar year.

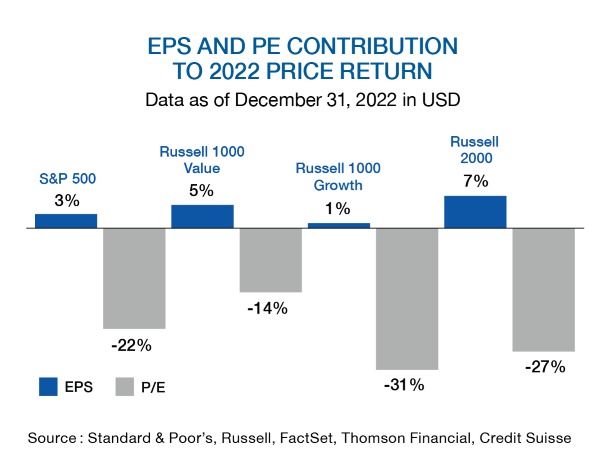

Yet, despite disappointing stock market returns (see table above), overall publicly listed companies achieved respectable financial results during the year - successfully increasing their earnings per share (EPS) by around 3%. In summary, the story of 2022 is one of contracting valuation multiples (price-to-earnings ratio) due to investors’ fears of inflation, interest rates and the depth of a possible recession. In the next chart, multiples also show a deeper contraction of multiples for growth stocks (-31% for the Russell 1000 Growth Index) than for value stocks (-14% for the Russell 1000 Value Index), mainly as a result of a downward revision of future growth for technology stocks.

Our portfolios: a silver lining

In 2022, Canadian investors fared better than just about any other investors in the world. First, our equity market benefited from its high exposure to natural resources, while Russia, also heavily exposed to these sectors, was distracted and boycotted. In addition, our foreign investments benefited from the 7.2% strengthening of the greenback against the Canadian dollar, dampening the decline.

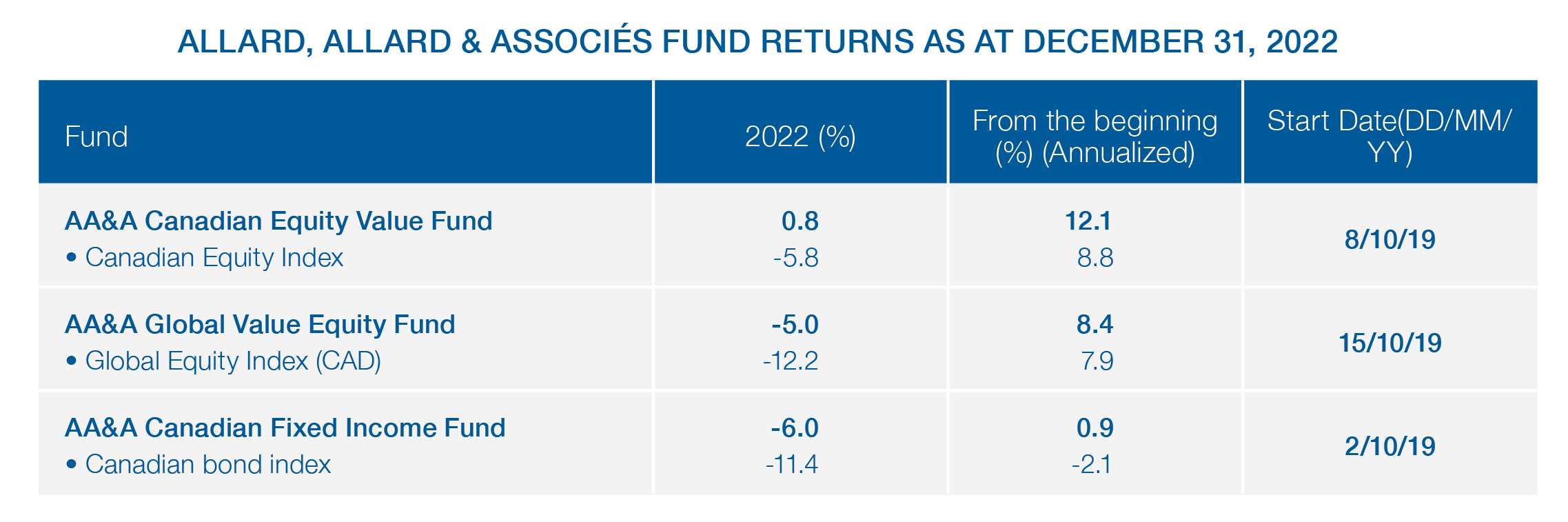

In addition, at Allard, Allard & Associates, our goal is to outperform the markets through full cycles and our track record of performance speaks to our success. Notably, our Canadian equity composite has exceeded its market index by an average of 3.8% per year (11.9% vs. 8.1%) since 1995. It is especially in the most challenging markets that we have distinguished ourselves, historically avoiding an average of 25% of the declines.

Like you, we prefer when returns are strongly positive, as was the case in 2021 when our equity strategies achieved returns in the range of 20%. In 2022, our approach continued to shine in times of adversity as all our strategies outperformed their benchmarks (see AA&A Funds performance chart below).

Outlook

2023 should experience a slowdown in inflation and a transition to a more stable period of inflation and interest rates in the coming years. Short-term interest rates, after continuing to rise during the first part of the year, may begin to fall afterwards. Against this backdrop, we can imagine that bond market returns will be much higher in 2023 than they were in the past year. For equities, generated will attract capital from investors wishing to grow their wealth. Despite the vagaries of the equity markets, we remain convinced of the long-term wealth creation potential of investors holding stocks of profitable companies with a strong balance sheet purchased at a fair price.

Did you know that

To include an RRSP contribution on your 2022 income tax return, it must have been made by March 1st, 2023. The maximum RRSP contribution limit is 18% of your earned income, up to a maximum of $29,210 in 2022 and $30,780 in 2023.

For your TFSA, in 2023, the contribution limit was raised to $6,500. As a result, the total TFSA contribution room since inception is now $88,000, if you were at least 18 years old in 2009 and have remained a Canadian resident ever since.

The federal government announced in its 2022 Budget the creation of a new registered plan, the Tax-Free First- Time Home Buyers’ Savings Account (FHSA), which will be launched in 2023. This account will allow prospective buyers to save up to $8,000 annually for a lifetime limit of $40,000. Like RRSPs, contributions will be tax deductible and withdrawals for first-time homebuyers, including investment income, will be tax-free, similar to a TFSA. This account is not yet available but will be in the course of the year. We will keep you informed of developments.

Author(s)