Market Commentary - Third Quarter 2022

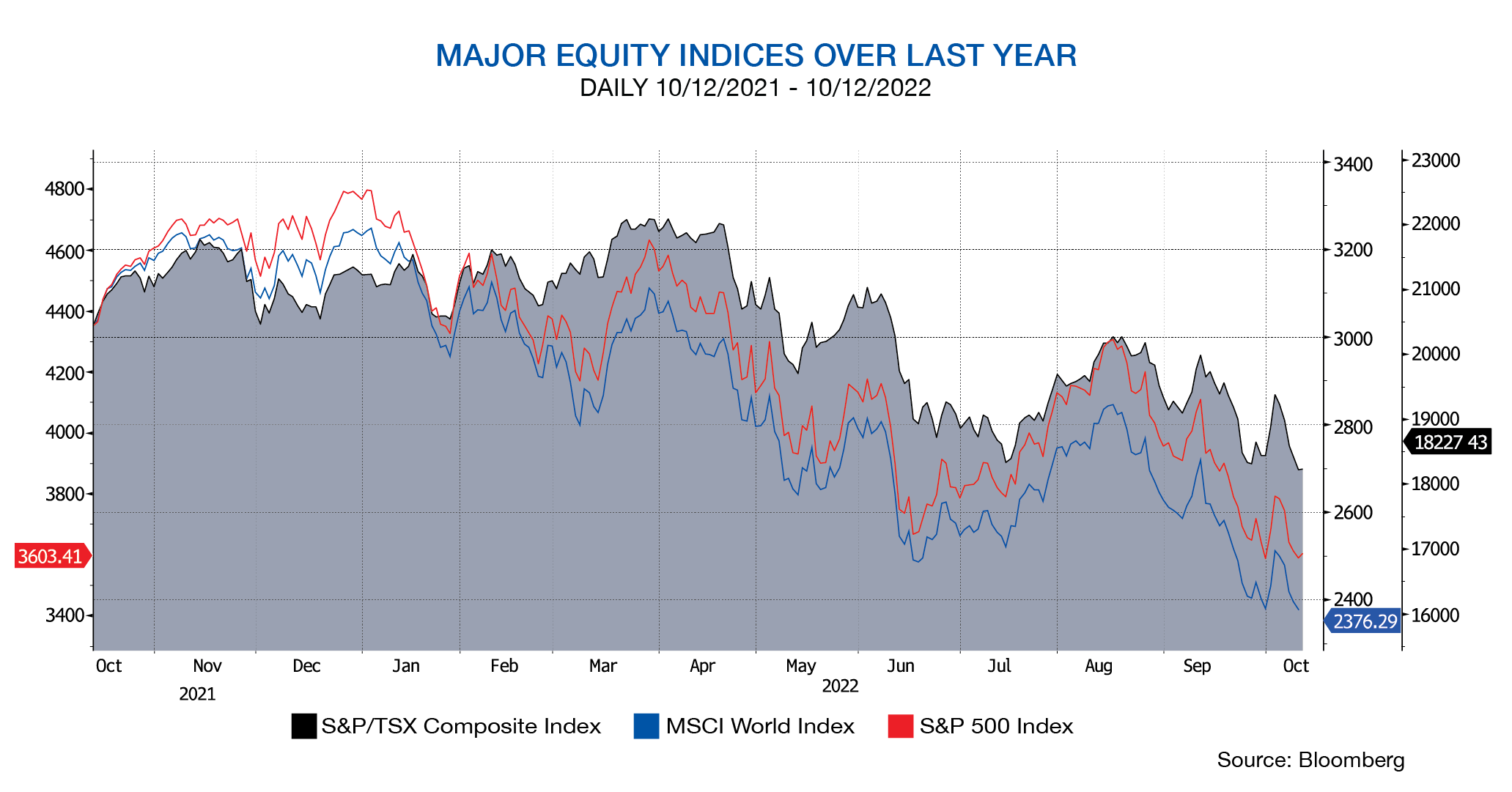

Global markets declined again in the third quarter as inflation remains near multi-decade highs, geopolitical tensions escalated further and the Federal Reserve continued its aggressive fight against inflation, signalling further hikes to come.

The third quarter of 2022 started with a solid rebound in both stocks and bonds as hope for a less hawkish Federal Reserve (Fed) paired with resilient corporate earnings and the perception that peak in inflation had been reached fired a 9.2% gain in the S&P500, while the TSX rose by just under 12%. The tide turned and these mid summer gains were squashed by central banks’ persistent determination to reign in inflation at all costs, as the Bank of Canada and the Federal Reserve both raised rates by 75 bps. Additionally, the Fed’s meeting minutes showed that the bankers were expecting to raise rates higher than anticipated by the markets.

Slowing Growth

On the economic front, falling new orders and rising inventories in the US and many other developed economies present a deteriorating outlook for global manufacturing activity. Consensus expectations have moderated in recent months, but forecasts still point to higher margins. However, we believe earnings expectations could prove to be too optimistic. Stickier inflation, higher wage growth and higher capital costs will put pressure on profit margins.

Overseas, China’s grudging recovery appears to have gained traction, as industrial activity ticked up amid the lifting of COVID lockdowns. Fiscal and monetary policy easing picked up steam, including measures targeted to support manufacturing, property, and consumer spending. The continuation of Zero-COVID policy remains a risk. Turning to Europe, it will see a recession and likely that the UK will as well, while the strong USD is pressuring growth nearly everywhere.

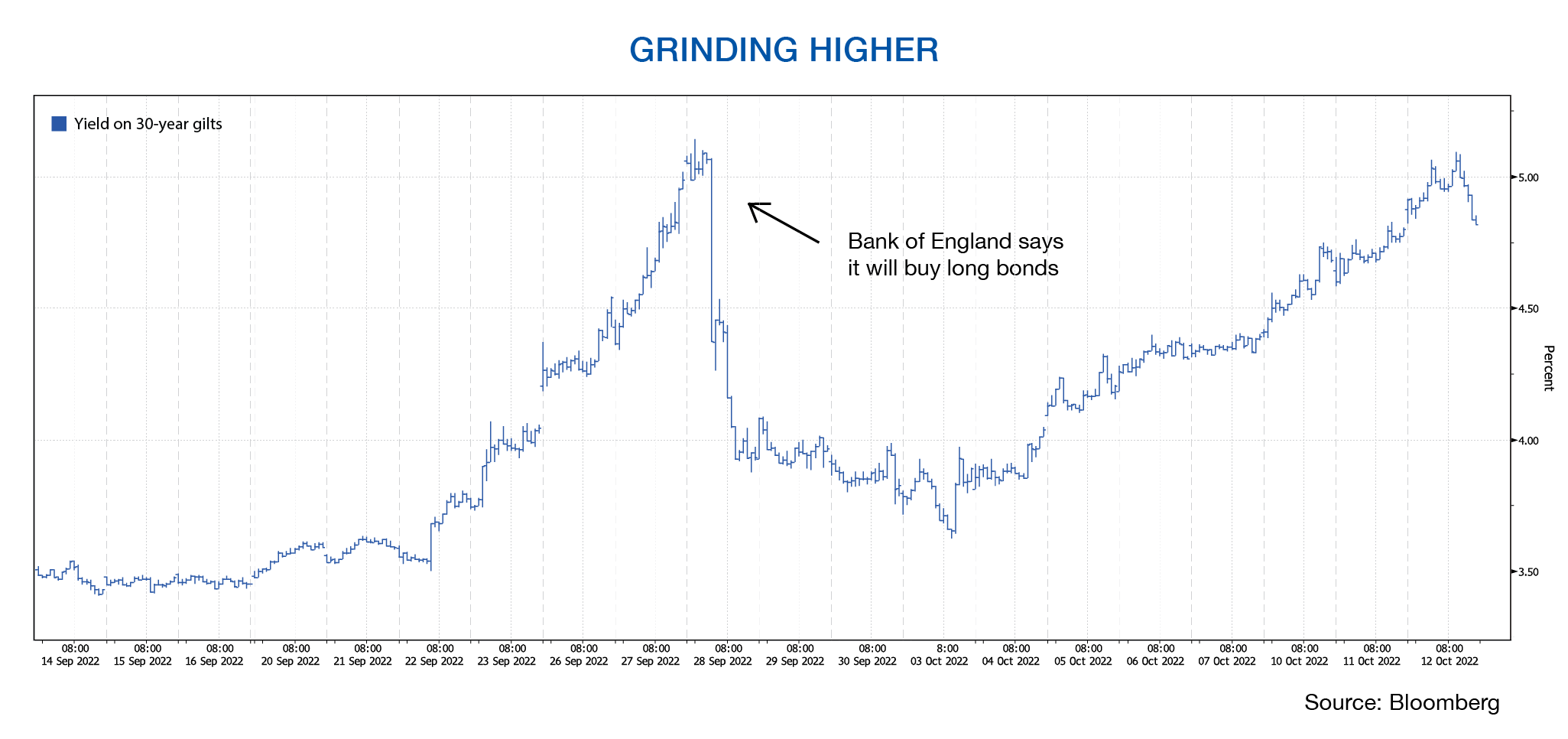

Capital markets and asset classes are facing considerable disruption and volatility this year due in large part to the global response to soaring inflation, exacerbated by geopolitical tensions. This weighed on consumer sentiment and business confidence, helping send stock prices back into bear-market territory. This downwards pressure accelerated towards the end of the quarter as most global markets saw a dramatic increase in volatility, exacerbated by the UK government announcing a spending package designed to stimulate the economy. But that would also add to inflationary pressure forcing the central banks to raise even more. The announcement resulted in a spike in yields while the pound dropped to an all-time low against the USD. This set off multiple alarms among investors & policy makers, evidenced by the BOE intervention in the UK bond market amid gilt sell-off.

Over the first three quarters of 2022, the S&P500 cemented its 3rd worst decline since 1950 and its 3rd straight quarterly loss for the first time since 2009.

Major global benchmarks were down approximately around 9% while, the bond markets were up by 0.5%. The 10YR US T/B rate had its biggest monthly gain in September. Energy and Consumer Staples were the only two sectors with positive performance this year on the TSX.

As volatility will likely remain elevated, the current environment calls for continued disciplined approach around stock picking, with diversification and a focus on balance sheet strength. On the bond front, a silver lining to rising rates is that after several years of extremely low bond yields, fixed income assets now offer relatively better income with more attractive valuations.

Did you know ?

Allard, Allard & Associés will be attending for the second time the Strategies PME conference as expert in the financial services field. The conference is held on November 16-17 at the Palais des Congrès. Please let us know if you would like to attend as we have several complementary tickets, each worth $395 to give away. First come, first serve.

Author(s)