Do I (will I) have enough savings to retire?

Defined benefit pension plans, under which employers commit to pay a pension to their retired employees for the remainder of their lives, are becoming much less common. As a result, a growing proportion of the population must finance its own retirement.

The process may seem complex, anxiety-inducing and raises many questions:

- How much should I save?

- How should I invest?

- When will I be able to retire?

- Do I have enough?

This quarter, we try to demystify the financial aspects of retirement, explain the options available to you to meet your financial goals related to retirement and highlight the importance of having a plan that aligns your means with your ambitions.

The usual path

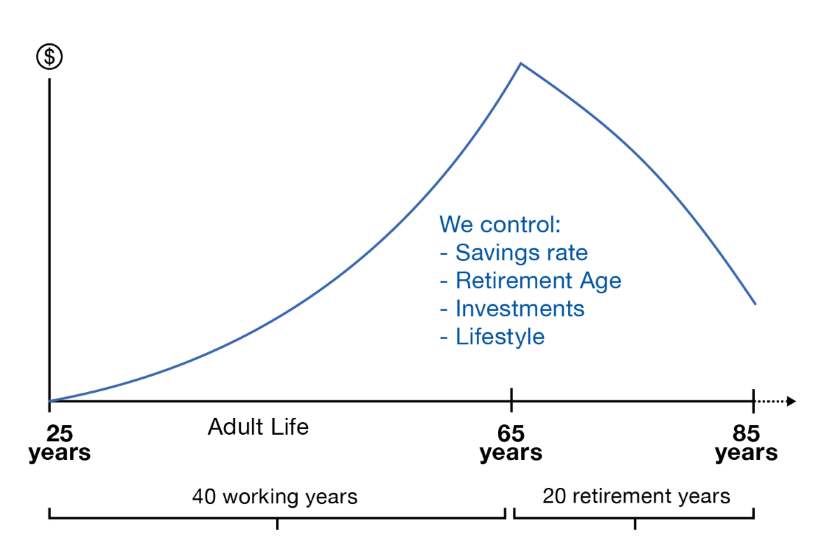

Generally speaking, we work for about two-thirds of our adult life to fund our retirement for the remaining one-third. During the first segment, the accumulation phase, we must save enough and ensure that our savings work properly for them to grow and are able to finance our pace of life during the second phase, the disbursement phase, when we will no longer be working.

The objective

The objective states what we aim to accomplish financially. It specifies the age of retirement, the desired lifestyle, the legacy we want to leave to future generations and our philanthropic objectives.

The plan

To achieve our objectives and alleviate our retirement anxiety, it is crucial to have a plan that works with pessimistic assumptions. For our clients, we can make a simple cash flow projection that will enable you to reconcile your means with your ambitions. In more complex cases, we will refer to financial planning services.

The variables of the plan

The savings rate

The amount set aside for retirement each year during the accumulation phase to fund the goal. A high savings rate allows both to have a greater retirement wealth and to contain lifestyle expenses - two factors favouring the financial success of a retirement plan.

The number of years of savings

The longer you work, the more you save and the lesser number of years of retirement you will need to finance. It should also be noted that thanks to the exponential growth of compound returns, the younger you save, the more time your savings and the returns generated will have time to work for you. One of the key risks to model is that of a premature retirement.

The number of years of retirement (longevity)

We do not know with certainty how many years of retirement we will need to finance. As such, the greatest risk for a retirement plan is the risk of longevity, i.e., the risk of living longer than your portfolio. To mitigate this risk, it is necessary to model for a much longer disbursement period than life expectancy.

Lifestyle in retirement

For most people, this element is difficult to determine. It is however important, before retiring, to reflect on what we plan to do in retirement and to budget how much it will cost. This variable must consider an inflation assumption. The lifestyle also tends to not are significantly more active than the following ones.

The rate of return on investments

Over the long term, equities provide better returns than fixed income securities, which have the advantage of offering more stable returns (less volatile). The proportion of equities and fixed income will impact both the strength of portfolio returns and its volatility. When making projections, conservatism and prudence are called for since over a long period of time, a small variation in the expected return assumption has a significant impact on projected outcomes. The Institut québécois de planification financière (IQPF) publishes its projection assumption standards every year.

One-time cash inflows or disbursements

It is important to plan the amounts to be received, for example, an inheritance, the sale of a business, the sale of real estate, etc. As well as large disbursements such as a new car, a second home, donations, etc.

Other income

The Canada Pension Plan (CPP) retirement pension, the Quebec Pension Plan (QPP) retirement pension and your other income also help pay for your retirement lifestyle.

How to do it

All this may seem tedious, but with simple means and a minimal time commitment, you can manage to have a better vision of your means and your ambitions. Tools are available on government websites, including Retraite Québec.

At Allard, Allard & Associés, we help our clients build and adjust their retirement plans and we have tools that enable us to model and visualize where you are in achieving your goals. Please connect with us to learn how we can help you.

Author(s)