A Strong Start to the Year Driven by Artificial Intelligence and an Improved Economic Outlook

North American economies have shown resilience, growing despite rising interest rates, persistent inflation and intensifying geopolitical tensions. The odds of a recession have given way to those of a soft landing.

In light of this, stock markets are enjoying an extraordinary year, reaching record levels.

While it's true that the markets have experienced excellent times on the whole, in reality, these returns can largely be attributed to a handful of artificial intelligence-related stocks.

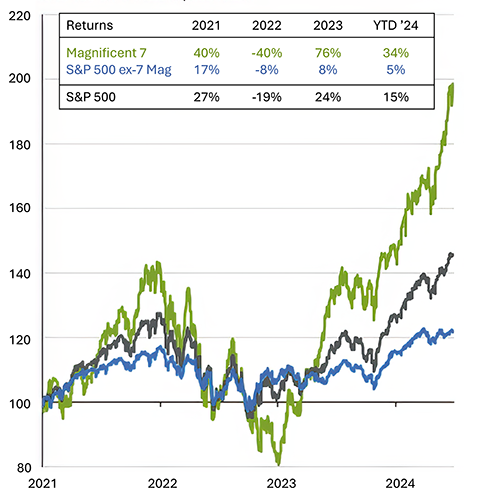

PERFORMANCE OF “MAGNIFICENT 7” STOCKS IN S&P 500 (USD)

As the accompanying chart illustrates, two-thirds of the US market's returns in 2023, and so far in 2024, stem from the rise of the "Magnificent 7" - the stocks regarded by the market as the agents of change who stand to benefit from the emergence of artificial intelligence (AI).

Nevertheless, the rest of the market has experienced a respectable start to the year, aided by higher profit

margins and a growing economy, having shrugged off the threat of recession.

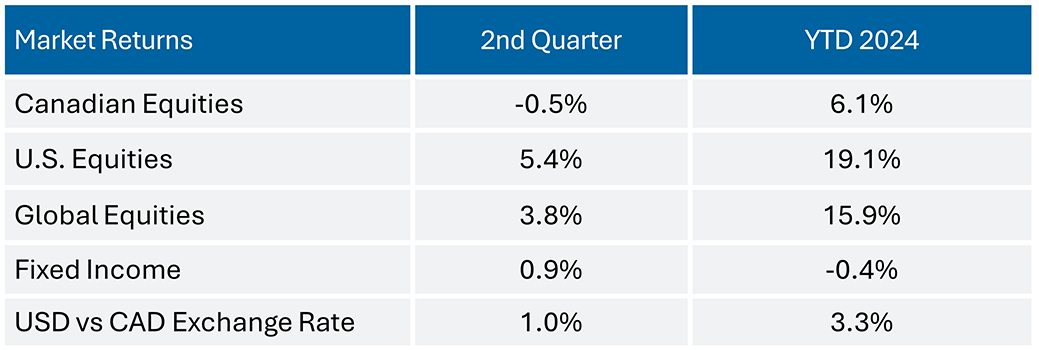

RETURNS ON MAJOR ASSET CLASSES (CAD)

Would it be beneficial to increase investments in technology stocks?

We often refer to the stock market as an auction, where buyers and sellers trade company shares. Warren Buffet has given a brilliant illustration of how markets work (see quote below). What moves stocks in the short run is the degree of enthusiasm; in the long run, the financial results move them forward.

"In the short run, the market is a voting machine but in the long run, it is a weighing machine." – Warren Buffet

In the short run - The Voting Machine: investors' currently insatiable appetite for AI-related stocks means that there is an imbalance between the large number of buyers and the small number of sellers, propelling prices upward.

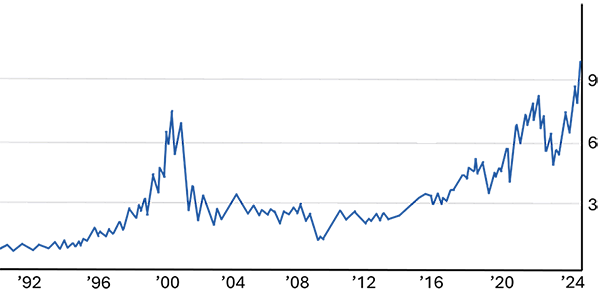

In the long run - The Weighing Machine: based on sales generated, shares in major technology companies have never been as expensive, even more so than at the turn of the millennium, when the technology bubble was at its height, and the Internet was set to change the world.

If we take a step back and examine the AI phenomenon rationally, we must ask ourselves how companies will manage to sufficiently monetize their solutions for shareholders to make money from this point forward. It's also easy to conceive that, as with the innovative solutions of the past, while competition and regulation are likely to gain prominence, enthusiasm is likely to fade as results fall short of over-optimistic expectations.

S&P 500 : TRAILING PRICE-TO-SALES

For more information about AI and our thoughts on the subject, we invite you to read or re-read our article from last summer. (The emergence of artificial intelligence (“AI”) and its similarities with the Internet).

Outlook:

Although overall, markets are trading at elevated multiples (meaning that stocks are expensive in relation to their historical averages), when US technology stocks are excluded, the prices are not that steep. We believe that AI, like the internet before it, will contribute to making companies more productive and, as a result, improve profit margins.

We also believe that bonds will deliver better returns over the next ten years than they have over the past ten years and that the decline in interest rates will occur at a slower pace than anticipated.

We maintain our belief that to achieve strong returns in a prudent and sustainable way, it is better to pay for proven results than promises. We therefore remain committed to making every effort to identify profitable, cash flow generating businesses that are financially sound and trading at attractive valuation multiples - the same approach that has served us effectively for almost 30 years.

Author(s)