The Year of Covid-19

Our memories of this last year will undoubtedly be linked to the global pandemic that defined it: from the omnipresent fear of becoming infected and infecting the people we care for to the containment measures that have forced us to change our daily habits and the way we interact with others.

Finally, 2020 is over

From an economic perspective, the pandemic will have resulted in the worst recession since the Great Depression. The fastest economic downturn in modern history also prompted an unprecedented government response. In addition to imposing restrictions on the population, our governments have taken on massive debt and spent lavishly to limit the damage induced by COVID-19. At the same time, seeing the virus spread around the world, the stock markets worried about the extent and duration of the pandemic and, because of this, the actual survival of numerous companies if the situation worsens and persists. At its low, the market had fallen by over 30% - the year was just beginning, and uncertainty was at its peak.

Since then, the year has taken on a fascinating and unexpected turn as the economy quickly regained about 70% of the lost ground and the stock markets quickly erased their decline to finish the year in positive territory. This rebound accelerated in the last two months of 2020 as the prospect of an unprecedented vaccination campaign allowed investors to envision the end of pandemic and adjust their financial models accordingly. Favourable expectations shifted from the digital economy, which had benefited greatly from the containment measures, towards the more traditional sectors of the economy, which in turn, fostered a resurgence for our value-style investment strategies. For example, our Canadian equity fund rebounded 23.6% in the last quarter of the year, outperforming its benchmark by nearly 15%.

Patience is the mother of all virtues

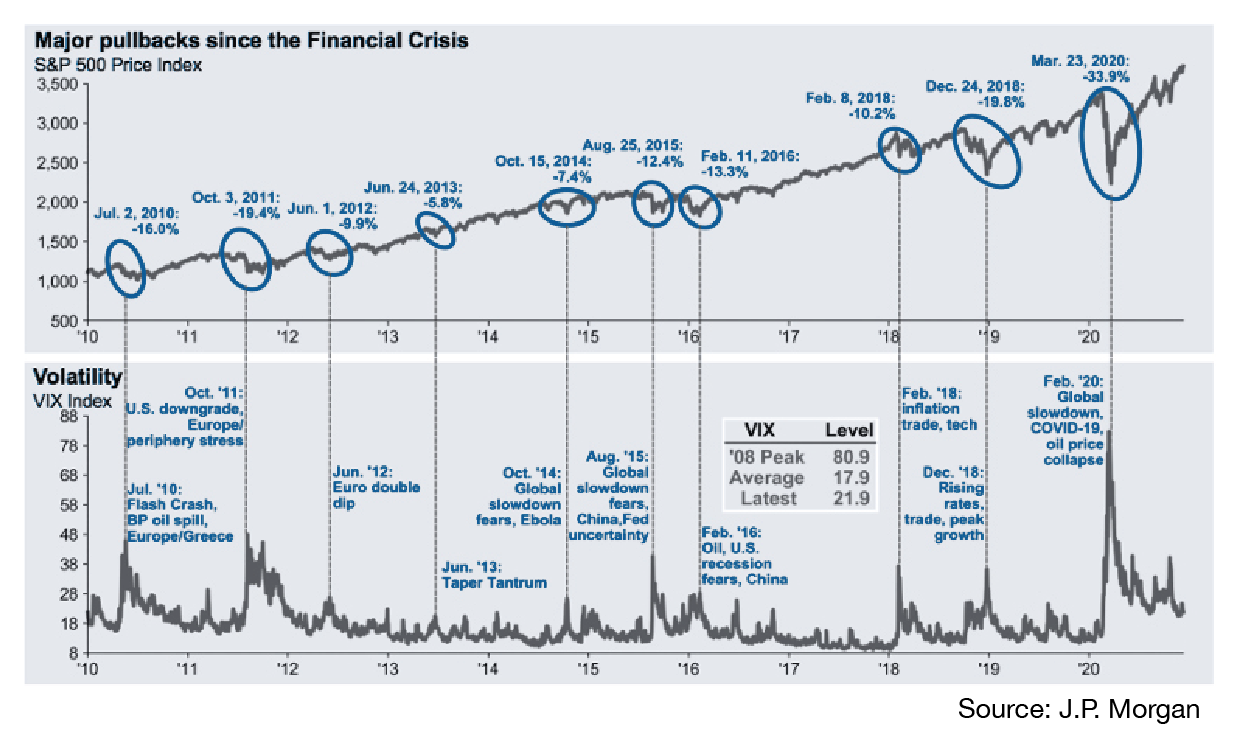

In 2020, investors’ patience will have been tested. In our first quarter update we explained the importance of staying the course during setbacks and the relevance of staying invested in the stock market. Once again, those who have been patient and maintained their strategy have been rewarded. Volatility is an inherent part of stock investing. A fairly long investment horizon and the ability to be patient in times of adversity are necessary conditions to achieve capital appreciation through stock market investments. The graph on the following page illustrates the declines in the US market (S&P 500) over the past 10 years, during a period of strong bullishness for the US market.

Outlook for 2021

Pandemics date back to the dawn of time. Viruses eventually fade when they can no longer reproduce and it is in 2021 that a large-scale vaccination campaign can curb the Coronavirus by immunizing a large segment of the population.

Uncertainty about returning to some form of normality remains. We still don’t know when it will be safe to take a plane, go to a concert, or just hang out with friends like before, but we can imagine that will be later this year. It is more difficult to predict which changes will be more permanent - especially in terms of the way we work (work-from home, videoconferences), travel (public transport, business trips), consume (e-commerce) and nations’ desire to be self-reliant for certain strategic goods, etc.

As businesspeople, we continue to invest in corporations that have enviable balance sheet, profitability and cash flow characteristics, and trade at attractive prices. In addition, we owe it to ourselves to understand the business model of these companies, to question ourselves about the risks that threaten them in addition to ensuring that their financial strength can allow them to face the temporary problems linked to the pandemic. Ultimately, we are confident that this approach is logical and that it will continue to yield good results.

Did you know?

AA&A FUND MANAGEMENT SOLUTION

For over a year now, our pooled fund solutions were launched to enable a healthy diversification for accounts of all sizes, provide consistent returns across all your accounts and also provide better access to international securities. If you are interested in learning more about AA&A funds, please feel free to contact our portfolio managers.

RRSP

In order for it to be included in your tax return for 2020, your RRSP contribution must be made by Monday March 1, 2021. The maximum RRSP contribution limits are $27,230 for 2020 and $27,830 for 2021.

TFSA

Since January 1, 2021 your TFSA contribution room has increased by $6,000. Therefore, the total contribution room for the TFSA since its inception in 2009 is now $75,500

Author(s)