Summary of the 2020 Third Quarter

The quarter unfolded in two distinct phases. In July and August, markets continued under the previous quarter’s momentum, encouraged by the strength of the job recovery and rising industrial production and discretionary spending. September was a different story, as rising COVID-19 cases combined with uncertainty over renewed government stimulus spending and heightened China-USA trade tension weighed on stock markets.

Overall, it was a strong third quarter with the Canadian market rising by 3.9% with nine of the eleven sectors posting positive returns led in particular by the industrial and materials sectors. The small-cap segment, which had lagged since the start of the pandemic, also outperformed (+ 6%). Globally markets were up by nearly 5%, led as well by the strong industrials and materials sectors, finished ahead of Canada due to the inherent lower exposure to the energy sector which was down by 8%.

Meanwhile, the US dollar fell about 2% against the loonie during the quarter. The greenback had been a safe haven at the start of the pandemic back in March but we saw a reversal in this trend given the shrinking interest rate spread of U.S. debt versus other Western countries, as well as the faster increase in its public debt.

Outlook

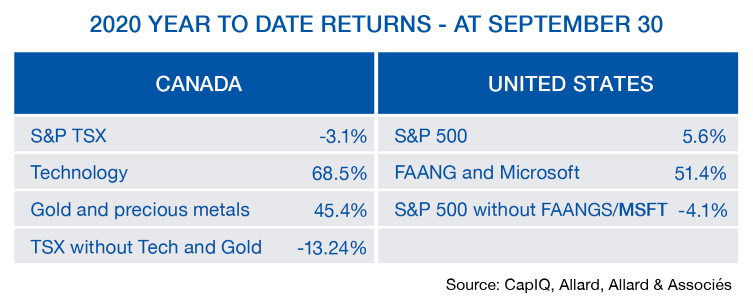

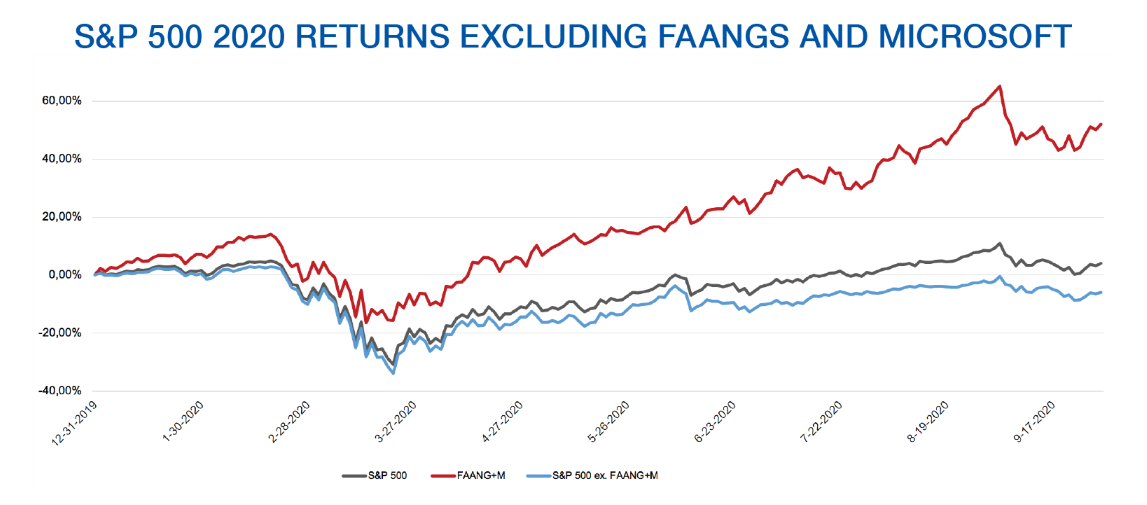

The market rally has been vigorous since the lows of last March and overall returns of -3.1% for the Canadian market, +5.6% (USD) for US stocks and +4.8% (CAD) for global stocks after three quarters this year look almost mundane despite the adversity the world has had to face. What the data does not show is that these returns are being driven by a thin minority of stocks while the vast majority of companies are having a challenging year. Indeed, we see a difference of close to -10% in returns when technology stocks and precious metals are removed from the TSX. By removing the FAANG+’s - the 6 tech giants (Facebook, Apple, Amazon, Netflix, Alphabet and Microsoft ) – out of the S&P 500, we also see returns fall by nearly 10%. This is captured by the graph on the next page and the returns showed below.

We believe that a return to more normal economic growth will be conductive to better performance in many of the non-tech stocks for which 2020 has been more difficult. This is what seems to be happening since the beginning of September which favours diversified strategies less exposed to technology such as ours.

The American election

A lot of ink flows around presidential elections, although historically the party that occupies the White House has had essentially no impact on stock returns.

On November 3 Americans will go to the polls to decide whether to give Republican President Donald Trump a second term or replace him with Democrat Joe Biden.

Below we highlight a summary of the main differences of the Biden option versus the status quo:

Higher taxes, mostly targeting higher income earners ($400K+) as well as corporations and regulations, mostly aimed at limiting market share concentration of “big tech”;

A national approach to the pandemic including more vigor in economic stimulus, including higher infrastructure spending;

Less protectionism and less tension with trading partners.

For the stock markets, an increase in corporate taxe rates would not be favorable in the shorter term, however, a more concerted approach to the pandemic and a more significant stimulus program would be beneficial. Furthermore, greater openness to the world and more cordial relations between trading partners would also undoubtedly have beneficial effects in the longer term.

Lastly, the specter of stricter regulations linked to a Democratic victory is expected to weigh on big tech stocks that will have to defend themselves from becoming monopolies.

Did you know?

Allard, Allard & Associés launched investment funds a year ago. These funds now allow us to effectively deploy our strategies in accounts of all sizes such as the accounts of your adult children. Please contact us if this applies to your situation.

Author(s)