2020: Stock Market Investment: Back to Basics

In this time of uncertainty, we felt that answering a few simple questions could help put some of the recent events back into perspective. We will also, in so doing, reiterate some of the core principles supporting the argument for stock market investing and provide you with some relevant data points.

How does the stock market work?

First off, companies listed on stock exchanges are owned or belong to its shareholders with ownership levels determined in proportion to the number of shares held.

Simplistically, the stock market works much like an auction house, where investors have a platform to negotiate in order to buy and sell certain securities.

Ultimately, the “intrinsic” value of a company depends on quantifiable fundamental data such as the balance sheet, financial results, cash flow generation and projections of these elements in the future. However, it is the supply and demand for the stock, determined as buyers and sellers “meet" on the stock exchange that assigns a price to a company on any given day.

Thus, in the short-term stock prices can diverge from their intrinsic value as they are dependent on supply and demand at a specific point in time.

What is a bear market?

From a technical perspective, a bear market is defined as a market decline in excess of 20%. Since the Second World War, there have been 14 instances when the S&P 500 US market index has declined by at least that amount. As such, bear markets have occurred roughly every 5 years, registering declines of around 33% and spanning roughly a 15-month period.

As previously noted, there are times when a company’s stock price differs from its intrinsic value, since investors are ultimately human beings and it is human nature to extrapolate recent events to form an opinion about the future. This explains why, in bear markets, optimism gives way to fear, and the number of sellers begins to exceed the number of buyers, and thus consequently, at the auction, prices fall.

Historically, this balance between the number of buyers and the number of sellers has always been restored, with the market rebounding and eventually surpassing the levels seen prior to the onset of the bear market. In fact, the 12 months period following the bear market trough has typically seen very strong stock returns with an average rebound of over 47%, with much of this gain typically occurring in the first month of the rebound.

Can we lose everything?

Under the assumptions that capitalism as an economic and political system continues to exist and thrive, and thus implying no widespread nationalization of private companies, we believe companies that meet an economic need through their product or service offering, to continue to generate profits. These profits in turn will continue to attract investors and their capital. As a consequence, it is clear to see that under these conditions the stock markets cannot see their value evaporate completely.

This does not mean that all companies will survive in challenging times. Some do not have the financial strength necessary to survive and maybe forced into bankruptcy by their creditors. Hence the importance of investing in companies with solid balance sheets which provides protection in difficult times and provides these companies a measure of flexibility to emerge from periods of adversity.

Why should we stay the course and keep our investments during market downturns?

From 1900 to 2019, the U.S. stock market offered average compound annual returns of 9.6%. As inflation averaged around 3% per year, the average real return (above inflation) on stocks was 6.6%. During the same period, the real return on bonds was around 2%. We can therefore conclude that despite many strenuous bear markets, such as the Great Depression of 1929 and the financial crisis of 2008, stocks offer attractive long-term returns.

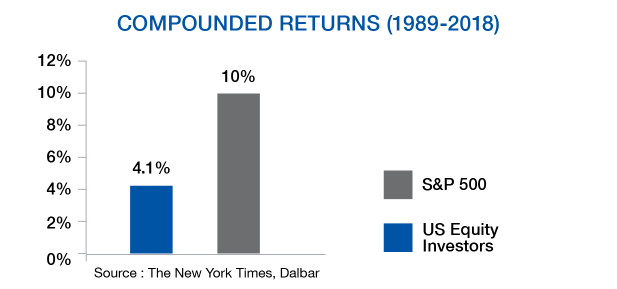

Trying to time stock market sales and purchases with market movements (“market timing”) is not a proven strategy. Given that investors often let their emotions dictate their decisions, many tend to sell in a panic during a market decline and, conversely, rush to buy in a surge of enthusiasm following a rise. Dalbar Inc., a firm which has been analyzing investor behavior since 1994, has quantified the impact of this strategy on investors' portfolios. According to their analysis as at December 31, 2018, over a period of 30 years, the average American investor in equities has obtained returns of 4.1% per year compared to 10% for the S&P 500. They concluded that unsuccessful attempts at timing the market explain more than half of the performance gap.

Tracking investors' inflows and outflows against market movements supports the argument that investors fail to properly anticipate market trends. Money tends to flow to an asset class after it has done really well and conversely, disappointing recent performance leads to after the fact increased cash outflows.

So why invest in equities?

A dollar invested in American equities in 1900 has multiplied its purchasing power by a factor of 1,937 up until the end of 2019, while a dollar invested in bonds has multiplied its purchasing power by a factor of 11 over the same period. The numbers demonstrate undeniably that over the long run, being a business owner through stock ownership allows investors to significantly grow their wealth. The price to pay for this benefit in wealth growth is the displeasure related to market volatility, more specifically declines as experienced during bear markets.

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.” — Warren Buffet

Of course, bear markets are sometimes violent, often occur over a short period of time and come without warning. Fortunately, they are temporary, and stock prices ultimately come out of their torpor. To avoid making the losses linked to these setbacks permanent, we must be patient and avoid selling our stocks when their price has fallen below their intrinsic value.

Since 1995, Allard, Allard & Associés has been managing investment portfolios for the benefit of third party investors. Our diverse client base includes private clients, foundations and pension plans. Our assets under management now total more than $750M.

Author(s)