Is the Value Style Still Relevant?

Since the credit crisis more than 10 years ago, growth stocks have done better than value stocks. The extent and persistence of the growth style's outperformance over value style during this period has led many investors to question the current and future relevance of the value approach when investing. To answer this question, we must first go back to the definition of the two approaches and examine how they have behaved in the past and why.

Definition of management styles

Value and growth style securities are typically defined based on their valuation multiples (price / earnings, price / book value, price / cash flow, etc.). Value securities are those whose multiples (prices) are lower, whereas conversely, growth securities have higher prices. All things being equal, it is understandable that a rational investor will be willing to pay more for a company with better earnings growth prospects. As a result, securities with lower valuation multiples are typically those for which growth expectations are more modest.

Historical returns of approaches

Looking at long-term performance figures, we are faced with limited data as the style indices are relatively young. Fortunately, professors Eugene Fama and Ken French rebuilt style portfolios dating back to the 1920s by dividing the market according to price / book value. They did this specifically for the overall US equity market and also according to the size of market capitalization. As we can see below, for more than 90 years, the value style has performed better than the growth style by 3.2% per year. For smaller-cap companies, the difference of 6% per year in favor of the value style is even more notable.

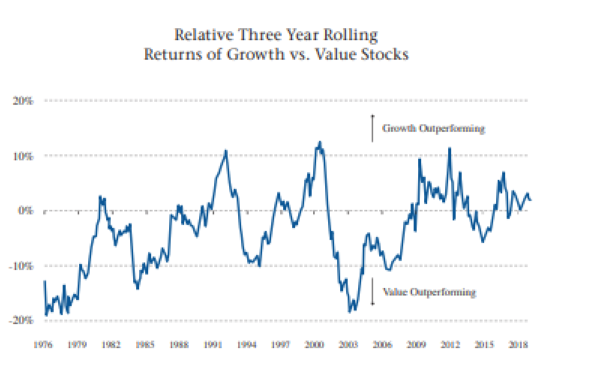

We have charted the outperformance of either the growth or value style in relation to each other over the last 40 years in the accompanying graph. As we can see, the growth style has outperformed recently. However, it has been more often the opposite. One can easily conclude that over shorter periods, the two styles each have their strong moments.

The value effect

Investors refer to the outperformance of value securities over time as the value effect. It is one of the most well known market anomalies that our investment approach has captured over time.

Although it is difficult to explain this phenomenon, the most logical assumption is that there are behavioral biases on the part of investors towards the expectations of future results. The human being tends to extrapolate the recent past into the future, which often leads to irrational decisions. Extrapolating this way, investors tend to overestimate the future profits of fast-growing companies and as well as overestimating the adversity that awaits companies with disappointing results.

Thus, a value approach avoids investing in companies whose price is unfairly inflated by too optimistic expectations, rather deploying capital into the equity of companies whose value has been penalized by excessive pessimism.

"Prediction is a very complicated exercise, especially when it concerns the future. " Nils Bohr - Nobel Prize in Physics 1922

Outlook

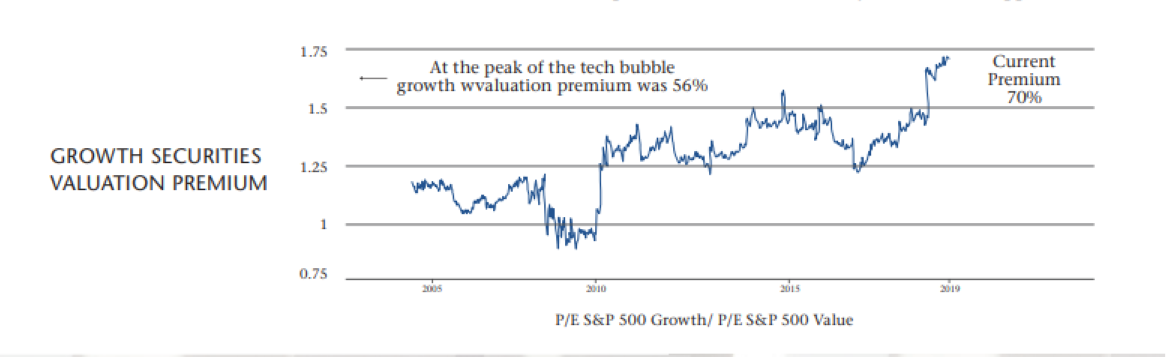

Historically, based on the price-earnings ratio, the average premium paid for growth securities relative to value securities has been around 25%. At the peak of the technological bubble at the turn of the millennium, this premium stood at 56%. Over the past year, the exuberance in growth stocks has pushed the valuation premium to an unprecedented level of over 70%. This strong surge in the premium has boosted returns of growth stocks and, as a result, has contributed to a lacklustre performance for value-style strategies over the past few years with respect to market indices.

Looking forward, as there is no sign of any significant improvement in the accuracy of investor forecasts, we can assume that behavioral errors will persist and that the premium paid for growth stocks will return to a normal level. This will result in a return of the pendulum, with an outperformance of the value style.

Looking forward, as there is no sign of any significant improvement in the accuracy of investor forecasts, we can assume that behavioral errors will persist and that the premium paid for growth stocks will return to a normal level. This will result in a return of the pendulum, with an outperformance of the value style.

This is how we have maintained our convictions over the years and have refrained from investing in Nortel, Research In Motion and Valeant, which have, in turn, experienced a euphoric and dazzling rise to become the largest market capitalization in Canada only to then experienced a similar dramatic decline.

Trees do not grow to the sky and, as common sense always prevails over long periods of time, we are convinced that the best thing to do in the long run is to continue to invest at fair prices in profitable businesses, well capitalized and generating strong cash flow. The return of common sense will lead to a normalization of valuation premiums for growth stocks and a significant outperformance of our value-style investment approach.

Author(s)