2018: A Self-Fulfilling Crisis

Early optimism exhibited in the stock market was overcome by increased pessimism and caution in the final months of 2018. Investors grew nervous in the face of rising geopolitical tensions (Sino-US trade war and Brexit), and the continued rise in interest rates, which was seen negatively impacting economic growth expectations.

The resulting reassessment of future growth expectations had a widespread negative impact on stock prices. Thus, 55% of stocks in the US market and 58% of those in the Canadian market fell by at least 20% from their peak by year-end.

Outlook for 2019: A year of opportunities

Taking a step back, we see several positive elements that should prove favorable for markets in 2019. In both the United States and Canada, the economy is doing well and unemployment rates are at their lowest levels in nearly 50 years. Interest rates, although rising, remain low by historical standards, inflation is under control and earnings growth remains strong. Moreover, it would be logical for China and the United States to work towards reaching an agreement, as there are no winners in a trade war.

The good news following a year like the one we just went through is that there is more discipline in the markets. Investor appetite for momentum and growth regardless of price paid should shift towards a focus on stability of earnings and the attractiveness of valuation multiples.

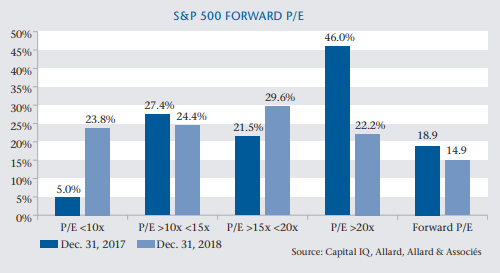

As we begin 2019, we are encouraged by the number of attractive stocks available in the market. Notice the chart below which compares the current valuation baskets of the S&P 500 relative to a year ago. It is quickly apparent that the proportion of very expensive stocks with price/earnings (P/E) multiples above 20x has fallen sharply in favor of much cheaper securities with multiples under 10x.

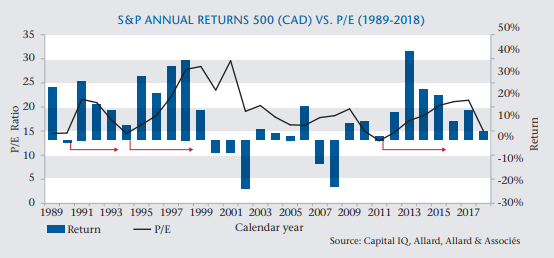

Interestingly, recent history has shown that when the average P/E ratio of the S&P 500 falls below 15x, returns tend to be vigorous the following years.

Our Strategy

As business people, we are excited by the current environment where we see numerous attractive investment opportunities. We are taking advantage of what we feel are bargain prices to acquire high-quality, attractively-priced stocks that should pave the way for strong risk-adjusted returns in the years to come.

“Two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And

the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are

fearful.” – Warren Buffet

Did you know?

RRSP, TFSA AND MANAGEMENT FEES

To include an RRSP contribution in your tax return for 2018, it must be made no later than, Friday March 1st, 2019. The maximum RRSP contribution is $26,230 for 2018 and $26,500 for 2019.

For the TFSA, since January 1st, 2019, your contribution space has increased by $6,000. Therefore, the total TFSA contribution limit since its introduction in 2009 now amounts to $63,500.

Our management fees for non-registered accounts are tax deductible, so please keep your quarterly invoices and include them in your income tax returns.

Author(s)