Growth Stocks Lead the Markets

In recent years, growth stocks have largely outperformed the various stock markets around the world. This trend has accelerated sharply since the beginning of the current year.

In Canada this year, more than half of the sectors posted negative returns. The health care and information technology sectors were by far the best performers in the first nine months of the year. Marijuana stocks whose valuations are almost entirely dependent on growth expectations were responsible for health care’s outperformance. It was also strong growth expectations that propelled some of the stocks in the information technology sector.

Elsewhere in the world, FAANG (Facebook, Amazon, Apple, Netflix and Google) is the acronym for growth stocks that are changing the world. By adding Microsoft to the FAANGs, you end up with a handful of stocks which account for nearly a quarter of the US stock market’s performance of the last five years.

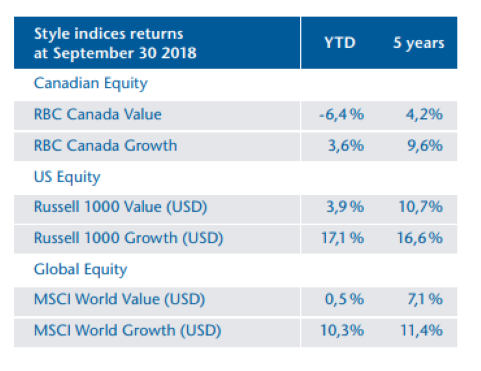

Comparing investment styles

The universe of portfolio managers is divided into two broad groups, value managers and growth managers. To define them summarily, the value style is based on the search for bargains - companies that are cheaper than their intrinsic value - while the growth style is based on investing in companies with high earnings growth expectations.

Is the value style still relevant?

The best get rich quick stock market stories usually come from the growth style: from companies that have been able to revolutionize their industry and whose earnings growth has surpassed expectations. Conversely, a lot of the worst stock market stories also come from growth stocks that have failed to deliver earnings growth that matched expectations and consequently saw their values fall.

Although it is less exciting, the value style stands out above all when facing adversity - during market downturns.

Indeed, since the price paid for future growth is an important component of valuation for growth securities, when the economy contracts and expectations of future growth are revised downward, growth stocks typically suffer the larger declines during stock market corrections. On the other hand, value stocks with more modest growth expectations and less expensive stock valuations tend to better maintain their value in turbulent times.

In the long run, over full market cycles, the value style has historically outperformed the growth style. Over the last five years the value style has not done as well. The absence of a stock market correction during that period likely has something to do with it.

One of the certainties of the stock markets is that there will be setbacks. Since they are almost impossible to predict effectively, a good way to mitigate their effects is to adopt a value-based strategy.

For more details and for the benefits of value style investing for various types if investors, please refer to our April 2017 To The Point: Benefits of Portfolios With Low Downside Capture.

Author(s)