A Volatile First Quarter to Start the Year

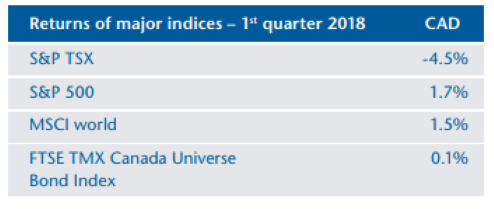

In the first quarter of 2018, investors had sharp reactions to the political, monetary and economic headlines. These included election meddling investigations, White House turnover, global interest rate levels, commodity price movements and oil inventories to name a few. Add to the mix a series of high-profile elections around the world and you have a cocktail for significant market volatility. We take comfort in the fact that with a disciplined approach to investing, volatility often rhymes with opportunity.

The global economy remains strong and fiscal stimulus seems to be boosting an already healthy US economy. Employment and productivity are doing well and inflation is gradually picking up.

In Canada, the energy, precious metals and health care sectors all lagged, while information technology companies overall, did better than the S&P TSX Index. Year to date, our loonie has depreciated by nearly 2.4% vis-à-vis its US counterpart.

Market outlook

We have never felt comfortable making predictions as we are still looking for a reliable crystal ball. Nevertheless, we believe that the corporate earnings outlook remains encouraging due to generally favourable economic conditions. In addition, the tax cuts announced south of the border have already proven to be an important tailwind for corporate profits and the economy.

Admittedly, the threat of a trade war between China and the United States casts a shadow on the horizon. We are, however, of the opinion that these two countries benefit from trade and will ultimately resolve their issues.

Interest rates, despite a gradual increase, are expected to remain historically low for a few more years. The flattening of the yield curves continues; while central banks are increasing rates in the short term, long-term rates remain low. We remain of the opinion that the risk of a recession is relatively low.

We maintain a favourable bias towards equities and prefer, where appropriate, short-term corporate bonds.

Stay the course

We continue to believe that ownership of high-quality, profitable, well capitalized and cash-flow-generating businesses, when acquired at a good price, will lead to prudent, consistent and superior growth of your portfolios over the long term. Our historical performance supports our view.

OUR VIEW ON CRYPTOCURRENCIES AND MARIJUANA

The shares of companies related to the marijuana industry - both recreational and medicinal - are driven by a speculative movement that can sometimes give investors vertigo. The legislative and judicial contexts of the industry remain unknown; the anticipated profitability of its companies is therefore also unknown. In addition, we believe that the production and processing of a non-differentiable resource within the reach of an amateur gardener suggests difficult market conditions. Not to mention the propensity of black market participants to protect their territory...

By definition, a currency has to be durable, portable, divisible, and intrinsically or fundamentally unequivocal. It must also be a means of exchange, a unit of account and a store of value. In our opinion, cryptocurrencies have no intrinsic value and, being unregulated, hardly fulfill their functions as money. The risks are numerous; fraud, devaluation, extreme volatility and nebulous origination process, among many others. However, the technology supporting cryptocurrencies, the blockchain, seems destined for a bright future, with major financial institutions and central banks becoming more and more interested in its use.

CONCLUSION

"Price is what you pay and value is what you get" said the Oracle of Omaha. Your portfolio managers understand the difference between value and price; you will not be surprised to notice the absence of cryptocurrencies and marijuana growers in your portfolios. Remember the tulip mania of the 17th century.

Update on the firm

In March, we were awarded a global equity mandate under the QEMP.

In February, at the Top 25 annual Gala of the Quebec financial industry, we were finalists in the Independent Manager category.

We are pleased to announce that in January we became signatories to the PRI, the United Nations Principles for Responsible Investment.

Author(s)