Againts All Odds, 2017 Was a Strong Year for Stock Market Returns

In 2017 there were, many significant events, notably: The rise of tensions between North Korea and the United States, the Catalan independence vote, numerous terrorist attacks, strong and numerous tropical storms, earthquakes, the “paradise papers”, etc.

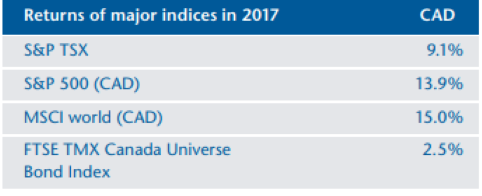

None of this managed to shake up the rise in stock markets, which kept on progressing in 2017. The Canadian market (9.1%) performed well, even though it lagged the US market (13.9% in CAD). The loonie appreciated against the greenback (6.5%). In Canada, only the energy sector failed to provide a positive return for investors. South of the border, growth stocks were in the spotlight - the general rise in technology stocks brings back distant memories of the late 1990s.

Economic strength, particularly in employment, provided North American central banks with the necessary conditions to gradually increase their policy rates (by 0.5% in Canada and 0.75% in the United States). In this context, it was a bit surprising to note that long-term bonds outperformed shorter-term bonds. Preferred shares with rate resets performed very well in this environment.

Outlook for 2018

In the United States, the effects of monetary easing since the 2008 financial crisis combined with a more accommodating fiscal policy following President Trump's tax reform are creating a favorable environment for economic growth. We expect, the Fed will continue its tightening of monetary policy - in the form of interest rate hikes. The pace of rate increases by the Fed and the Bank of Canada, as well as government decisions, should remain the main focus of the economic press. In Canada, we expect the focus will also be on the price of resources, real estate and marijuana as well as consumer debt. Rising rates in the United States and Canada will undoubtedly weigh on bond portfolio returns.

There will always be adverse events for the economy and the markets. We do not believe that 2018 will be an exception. And while we realize that stock market returns will not always be positive, we believe that trying to predict harmful events is futile. Instead, we focus our efforts on buying profitable, financially sound businesses at a good price. Over time, the sustained, rigorous and disciplined application of these principles has allowed us to stay on course and grow our clients' capital while also better preserving capital in the face of adversity. We remain convinced that stock ownership of companies that meet our criteria is a prudent way to contribute to the growth of our clients' long term wealth.

« The best way to measure your investment success is not by whether you are beating the market but by whether you have put in place a financial plan and a behavioural discipline that are likely to get you where you want to go. In the end, what matters is not crossing the finish line before anybody else but just making sure you do cross it »

– Benjamin Graham – the father of value investing

Did you know?

RRSP, TFSA AND MANAGEMENT FEES

To include an RRSP contribution in your tax return for 2017, it must be made no later than, March 1, 2018. The maximum RRSP contribution is $26,010 for 2017 and $26,230 for 2018.

For the TFSA, since January 1, 2018, your contribution space has increased by $5,500. Therefore, the total TFSA contribution limit since its introduction in 2009 now amounts to $57,500. Hence, the total contribution room for a couple is $115,000. A significant amount that is worth optimizing. If your TFSA contributions have only been made in your accounts with us, we can inform you of the space available, otherwise you can get the information through the CRA with My Account.

Our management fees for non-registered accounts are tax deductible, so please keep your quarterly invoices and include them on your income tax returns.

NEW POSITIONS: DIRECTOR OF OPERATIONS AND CLIENT SUPPORT / VICE-PRESIDENT OPERATIONS AND CHIEF OF COMPLIANCE

Morgan Leroy is the contact person for all your operational questions: deposits, withdrawals, copies of statements and reports and for all your operational and administrative needs.

Along with his responsibilities as Chief Compliance Officer, Alexandre Lagacé will also continue to oversee the operations department and remains our technology expert.

Participation in Tremblant's 24H and Sainte-Justine Hospital's winter triathlon

Last December, our employees participated in Tremblant’s 24h alpine ski relay. In addition to strengthening the already tight ties, our team managed to raise over $11,000 in donations, more than doubling their original goal, for the benefit of sick or underprivileged children. In February 2018, they will join their efforts again for the children by participating in Sainte-Justine Hospital's winter triathlon.

Author(s)