The Benefits of a Low Capture of Market Declines

Evaluating an investment manager goes far beyond a simple measurement of whether the performance of a specific strategy has exceeded its relevant benchmark. A thorough analysis can help investors get a sense of the coherence and the consistency of the investment process and of the investment philosophy. It can also help understand personnel competence and consistency. Different quantitative measures also provide a better understanding of the risks associated with the achieved performance.

Definition of downside capture

Market capture ratios help easily assess the historical performance of a portfolio during rising markets and during declining markets. Investors can thus better understand how the portfolio behaves under various conditions and in what context it is likely to perform differently than its benchmark. Market capture ratios are measured by calculating the ratio of portfolio returns divided by index returns for periods when the index had either positive (upside capture) or negative returns (downside capture.

What are the benefits of low downside capture?

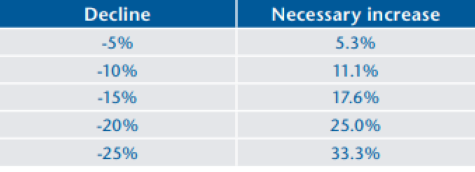

One of the obvious benefits is that by better preserving value during declines you ensure that more capital will be at work to take advantage of the ensuing turnaround. Therefore better capital preservation during downturns is an effective way to improve long-term returns. The table below illustrates the positive performance required to restore a portfolio's value to its pre-decline levels.

Benefits for individual investors

Private clients and foundations usually have clearly defined objectives and a coherent investment policy to achieve these objectives. However during periods of market declines, investors are often tempted to alter their asset allocation which could jeopardize the achievement of their long-term goals. Lower downside capture thus mitigates the risk of adverse behavioural errors during periods of market declines.

Benefits for foundations

In order to maintain their charitable status, foundations must distribute a minimum of 3.5% of the value of their portfolio annually. The distribution policy is more often challenged in the face of market declines. Unfortunately, market set-backs usually coincide with tougher economic conditions when donation volumes are lower, and the need of the charitable foundation for portfolio distributions is at its greastest.

Lower downside capture mitigates the pressure on the foundation’s investment committee and facilitates the preservation of distribution policies during market declines.

Benefits for pension funds

The objective of defined benefit pension plans is to fund employee retirement annuities. Periodically, the level of funding for a plan is assessed by comparing the value of the portfolio built to fund the annuities (the assets) to the present value of the annuities payable (the liabilities). When economic conditions are difficult and corporate profitability deteriorates, interest rates tend to fall. In such cases, stocks in the portfolio decline (assets are worth less) while the present value of the annuities increases (liabilities increase), given the lower discount rate, which is based on interest rates. The result is a deterioration in the funded status of the plan. An equity component with lower downside capture provides a better match between plan assets and liabilities and thus helps minimize actuarial deficits.

In summary, less downside risk results in:

A path easier to maintain, with fewer extremes;

An opportunity to increase the allocation to assets with better expected returns;

Decreased likelihood of having to increase savings to finance objectives;

Fewer withdrawals at inopportune times – for investors with disbursements.

Why does Allard, Allard & Associés have a lower downside capture?

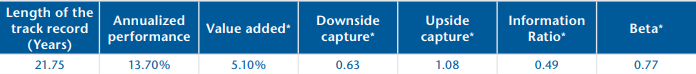

At March 31, 2017, our Canadian equity composite had the following historical performance:

A downside capture of 0.63 implies that, on average for more than 20 years, our Canadian equity portfolio has captured only 63% of the declines in the Canadian equity market – or, alternatively, it has avoided 37% of the declines. This result is largely owed to our management philosophy. Being value portfolio managers, we focus our efforts on buying profitable and financially healthy companies at attractive prices.

During market declines, growth is often reassessed downward and both growth stocks and aggressively levered companies tend to suffer more. The value stocks that we find appealing do not usually have strong growth expectations embedded in their valuation. However, they have strong balance sheets and, given the low purchase multiples, they tend to better preserve their value in down markets. It is the sustained, rigorous and disciplined application of our principles that allows us to stay the course and deliver strong and prudent long-term performance for our clients.

Author(s)