A Year of Surprises

Summary 2016

The fall in commodity prices in 2015 continued into early 2016 before bouncing back to the point where materials and energy became the two best-performing sectors in 2016 (after being the worst performers the previous year).

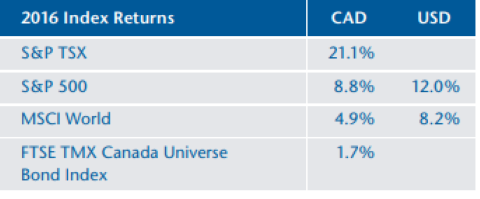

Very few predicted that the United Kingdom would vote in favour of leaving the European Union (Brexit) or that Donald Trump would become the US president. Needless to say, such predictions would have been accompanied by gloomy forecasts for stock markets. Yet stock market returns were quite strong in 2016. The Canadian market (21.1%) performed better than the US market (8.8% in CAD) for the first time in six years. The loonie appreciated slightly against the greenback (3.0%).

Interest rates rose in 2016, especially in the last quarter. In this context, shorter-term bonds and fixed-floater preferred shares performed relatively well.

Outlook for 2017

In the United States, aggressive monetary easing since the crisis, combined with expectations of a more accommodative fiscal policy under Republicans, suggests stronger economic growth ahead and a gradual tightening of monetary policy in the form of increases of the Fed funds rate. The pace of the FED rate hikes and the actions of the new government will be at the forefront of the economic press. In Canada, all eyes will remain on the price of resources, real estate and consumer debt. Several years of unappealing bonds yields suggest an eventual “great rotation” that would see investors reduce their portfolio weightings in bonds in favour of equities.

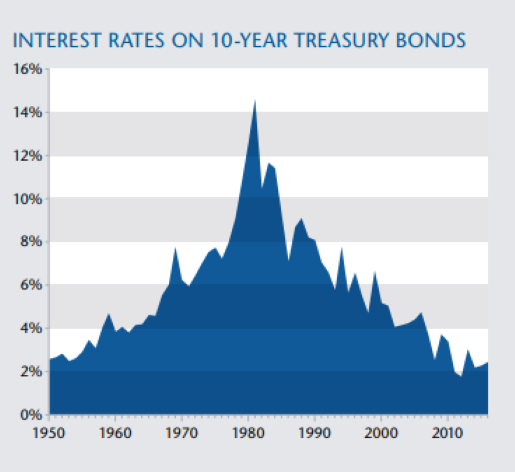

The rate hikes in the United States will undoubtedly result in negative bond returns. This context could be the catalyst for a significant rotation of assets from bonds into equities. The increased demand for equities would result in a multiple expansion or, if you prefer, higher stock prices. Conversely, a lower demand for bonds would weigh on their prices. The long-term downward trend in interest rates that has persisted since the early 1980s and has resulted in bond returns greater than historical averages is likely over.

There have always been adverse events for the economy and markets. We do not believe that 2017 will be an exception. In fact, we believe that changes the new US government will introduce are likely to increase market volatility in the coming year. However, we are of the view that attempting to predict unfavourable events is futile. Rather, we concentrate our efforts on buying profitable companies in good financial health at cheap prices. The sustained, rigorous and disciplined application of these principles allows us to stay the course and grow our clients’ capital in the long run. We remain convinced that holding shares in companies that meet our criteria will continue to contribute to the vigorous and prudent growth of our clients' assets over time.

Did you know?

RRSP, TFSA AND MANAGEMENT FEES

To include an RRSP contribution in your tax return for 2016, it must be made no later than Wednesday, March 1, 2017. The maximum RRSP contribution limits are $25,370 for 2016 and $26,010 for 2017.

For the TFSA, since January 1, 2017, your contribution space has increased by $5,500. Therefore, the total TFSA contribution limit since its introduction in 2009 now amounts to $52,000.

Our management fees for non-registered accounts are tax deductible, so please include them on your income tax returns and keep your quarterly invoices.

CRM 2 – FOR MORE TRANSPARENCY IN THE FINANCIAL INDUSTRY

You will obviously have noticed some changes to our end of year reports. The changes are much more important for investors at many other firms, as prior to the new regulation many advisors did not provide clear performance reports and were not transparent in terms of fees.

If there are investors in your circle who are unhappy with their advisor and share their discontent with you, do not hesitate to tell them about us.

Author(s)