Regulatory Changes Set to Improve Financial Industry Reporting and Disclosures

CRM2 – Client relationship model

Canadian Securities regulators have introduced new regulatory requirements to enhance the client-investment counselor relationship. The latest industry-wide regulatory update is known as “Client Relationship Model 2” (CRM2), and applies to all investment dealers and investment counselors in Canada. CRM2 will take full effect on January 1st 2017, and aims to increase the transparency and clarity of information provided to investors regarding investment performance and costs.

How will this impact you?

Your financial services providers will update their reports to ensure that their disclosures of costs and presentation of performance comply with the new rules.

Cost transparency

At Allard, Allard & Associés, we charge our fees quarterly and send our clients a comprehensive invoice detailing the calculation of management fees. This approach will be maintained as it already meets the standards set forth in CRM2. In addition, we will henceforth also be sending our clients an annual summary report of all management fees paid throughout the year.

Mutual fund unit holders will likely be the greatest beneficiaries of the new requirements as it will allow them to easily identify any fees paid to their investment advisor that are tied to their mutual fund holdings.

Performance Presentation

TIME-WEIGHTED RATE OF RETURN

Common practice in the financial industry is to present the time-weighted rate of return, which is defined as the compounded growth rate of $1 over the measurement period. The time-weighted formula is essentially a geometric mean of a number of holding-period returns that are linked together or compounded over time and annualized for periods longer than one year. The main advantage of the time-weighted rate of return method is that it allows for an apples to apples comparison of a portfolio manager’s returns with those of his peers and respective benchmark.

MONEY-WEIGHTED RATE OF RETURN

Going forward, portfolio managers will also be required to calculate the money-weighted rate of return of a portfolio. It fills an important gap given that the time-weighted method does not account for any cash inflows or outflows, such as deposits and withdrawals, and thus does not truly reflect your portfolio’s actual performance. The money-weighted return is derived by calculating the portfolio’s internal rate of return over a given period, and as such this method will tend to place a greater weight on the performance in periods when the account size is largest.

For portfolios with no significant deposits or withdrawals, the two methods will yield similar returns. However, returns may differ significantly depending on the timing and extent of deposits or withdrawals.

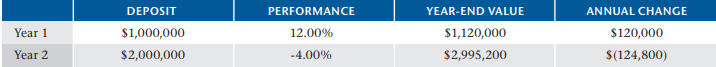

Example: In the first year, an investor initially deposits $1 million on January 1st and makes a return of 12% for the year. The following year, he adds $2 million on January 1st and the portfolio returns -4%.

This example clearly demonstrates the difference between the two methods. Under the time-weighted method, the portfolio has a positive annual return of 3.69% as you assign the same weight to both years. However, under the money-weighted method, which accounts for the threefold increase in portfolio assets at the beginning of the second year, annual returns are slightly negative as the decline in value of the 2nd year more than outweigh the gains made in the first year.

Conclusion

We believe the new regulatory requirements are well aligned with our current philosophy and reporting structures, and that these are positive developments for investors. For our part, we already present our fees in a transparent manner and address the various performance measures with investors when significant discrepancies arise between the time-weighted return and the money-weighted return.

Nonetheless, greater transparency regarding fees is certainly a positive. In addition to allowing investors to more easily identify the cost of their financial services, the new fee disclosure requirements will also create a more level playing field in the financial services sector, which we believe will benefit firms such as ours that are transparent in their disclosures of fees and comparatively less expensive.

Although the presentation of two different performance measures may create some confusion at first, we believe that the new regulations will prove to be beneficial as it will allow investors to better understand their portfolio’s performance. We are confident that with time, investors will become accustomed to the new presentation and be comfortable in that one of the methods presented measures the effectiveness of the investment strategy and allows for comparison with indices (time-weighted), while the other method measures the portfolio’s change in value over a given period taking into account deposits and withdrawals (money-weighted).

Did you Know?

In addition to selecting securities in your investment portfolios Allard, Allard & Associés also makes decisions on your behalf through proxy voting and ensures that you participate in relevant class actions. The latter two services are often not offered by the largest financial institutions.

In a recent class action, we collected nearly $100,000 for our clients.

Author(s)