A strong rebound in gold, metals and oil

Summary of the first half of 2016

During the first half of 2016, the Canadian stock market bounced back as the S&P TSX returned 9.8%. With this performance, the Canadian equity index erased its decline in 2015 and reversed the trend of underperformance with respect to foreign stock indices. In beating foreign stock indices, it was helped by the 6.6% drop in the US dollar which hurt the performance of foreign securities in Canadian dollars (S&P 500 -3.0% and MSCI World -5.9%). When we break down the performance of the S&P TSX the index for the first half of the year, we note the following.

Materials and Energy had 2/3 of the best-performing stocks;

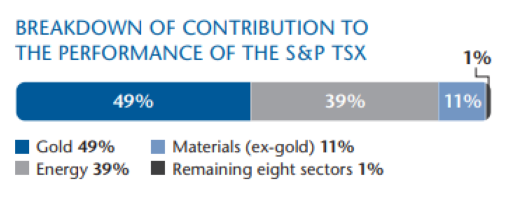

Despite integrated oil companies being at a standstill, the Energy sector, was up 19.3% – explaining 39% of the performance of the index (3.8% of 9.8%);

Gold stocks, up 94%, explained 49% of the performance of the index while the remainder of the Materials sector accounted for 11% more. All in all, Materials gets credit for 60% of the S&P TSX’s returns (5.9% of 9.8%);

Since Materials and Energy were responsible for 99% of the index performance, as a group, the eight other sectors accounted for a dismal 1% of the performance on the Canadian market (0.1% of 9.8%).

The surge in the price of gold was fuelled by the uncertainty linked to Britain’s decision to leave the European Union (Brexit). The risk of currency devaluation resulting from aggressive monetary policies around the world also contributes to the attractiveness of gold.

In the Energy sector, stocks of exploration & production companies, which had suffered greatly from the decline in the price of oil since mid-2014, have risen sharply this year after a perceived trough in oil prices was reached in February. Firmer oil prices improve the profitability of these companies and relieve some of the tension on their balance sheets.

Why doesn't Allard Allard & Associés invest in gold?

Nearly half of the performance of the S&P TSX can be attributed to the impressive performance of gold stocks since the beginning of the year (94%). You might then wonder why Allard, Allard & Associés does not invest in gold? In fact, we have never invested in gold stocks nor in physical gold. As business people, we do not believe in the long-term wealth creation ability of this industry given that the demand for gold is irrational.

Only 10% of the gold mined globally is used in industrial applications, with electronics being the main industrial use. The other 90% is used for investment purposes and for jewelry.

As a consequence of its low industrial utilization the demand for gold is more emotional than rational.

Our strategy

Our strategy does not change. The heart of our approach remains disciplined and rigorous work with a focus on the analysis and assessment of the financial performance of profitable and well-capitalized companies that are capable of paying dividends and whose shares trade at attractive valuations. This approach has allowed us to generate superior returns over the years and we remain confident that it is the best long-term way of investing as it provides a healthy combination of prudence and performance.

Updates

ALLARD ALLARD & ASSOCIÉS AWARDED A FIRST INSTITUTIONAL MANDATE THROUGH THE PGEQ

A Finance Montréal initiative, programme des gestionnaires en émergence du Québec (PGEQ) aims to help emerging Québec portfolio management firms gain access to the institutional market.

The selection and monitoring process of the PGEQ is carried out by a committee of recognized independent experts consisting of investment management consultants, university professors and portfolio managers from large institutional firms. This committee is supported by Innocap, the firm responsible for operational supervision and risk management. Investors in the PGEQ are pension funds and various Quebec institutional investors for whom the PGEQ allows a greater diversification of value added sources.

Allard, Allard & Associés was selected into the program from several applicants for a Canadian equity mandate which began in June 2016.

NEW EQUITY ANALYST JOINS OUR TEAM

To enhance our group of equity analysts, we are proud to announce the hire of François Watier, CFA, CBV. François holds a BA in Finance from Concordia University, is a CFA charter holder and a Chartered Business Valuator. Before joining Allard, Allard & Associés, he had worked with Duncan Ross Associates Ltd. and the National Bank.

Author(s)