2015: More Fear Than Harm

Summary of 2015

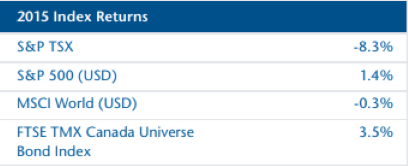

The last year was challenging for equity investors as several factors contributed to the weakness in the markets. With an impressive decline in commodity prices, companies exposed to natural resources had disappointing results. Divergence in monetary policies between countries/regions and the ensuing significant variation in exchange rates also had a strong impact on markets in 2015.

The Canadian stock market, more heavily exposed to commodities, declined by 8.3%. Foreign equities stood still in US dollars but for Canadian investors they provided vigorous returns given the 19.1% appreciation of the greenback against the loonie.

For Canadian investors holding both Canadian and foreign equities, the summary of 2015 is that after several years of strong returns since the 2008 crisis, portfolios ended the year almost where they started. They paused, and essentially what we lost is time.

Outlook for 2016

In Canada, weak commodity prices should continue to weigh adversely on the economy. However, government expenditures in infrastructure, export competitiveness resulting from a weak dollar and low financing costs should counterbalance the depressed prices in commodities.

In the US, things are much better as employment is strong and consumer confidence is high. In response to the ongoing recovery, the Fed raised interest rates in December for the first time since 2006. Although this reduces the risk of inflation, the strength of the dollar is a headwind as it hinders US exports and hampers earnings of the numerous multinational companies who report their results in US dollars.

Elsewhere on the planet: In Europe, the continued effects of the accommodative monetary policy should be positive for the economy and for equities.

With respect to emerging countries, several have seen their balance sheets deteriorate as a result of loans made in US dollars, but in general the nations where oil production is important suffer due to depressed oil prices (leading to recession: Russia, Brazil) while oil importing countries fare much better. Growth worries in China and its transition from manufacturing to services should impact the mood of the markets.

There has always been events that adversely impact the economy and the markets. We do not believe that 2016 will be immune to such events. However, we are of the view that attempting to predict this is futile. Rather, we concentrate our efforts on buying profitable companies in good financial health at a cheap price. It is the sustained, rigorous and disciplined application of these principles that allows us to stay the course and grow our clients’ capital in the long run.

Did you know?

1. RRIF and TFSA - significant changes

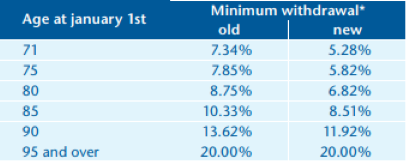

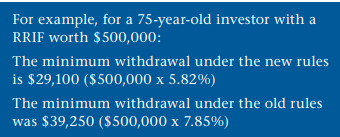

Minimum RRIF withdrawals were lowered to reflect the longer life expectancy of retirees. If you systematically withdraw the prescribed minimum from your RRIF, in 2016 you will therefore receive a smaller amount than in previous years (see table below).

2. 2015 tax reminders

To include an RRSP contribution in your tax return for the year 2015, it must be made no later than February 29, 2016. The maximum RRSP contribution limits are $24,930 for 2015 and $25,370 for 2016.

3. Allard, Allard & Associés team

In recent months, two new Equity Analysts joined the firm:

Kevin Maurice previously worked at Optimum Investment Management and at Hydro-Québec;

Erik Weldon previously worked with CIBC and Jarislowsky Fraser.

They join Ratko Velin and Maxime Robillard who both have been part of our equity research team for over five years. Supporting the portfolio managers, their mandate is to monitor the stocks in the portfolios and to uncover new investment ideas. The four analysts all hold master’s degrees in finance and are CFA charter holders (Chartered Financial Analyst). On average, they each have nearly ten years of industry experience.

Author(s)