Resources Are Setting the Pace for the Canadian Market

Market Summary

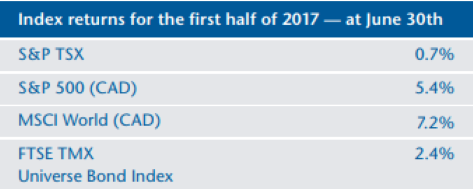

After spectacular returns in 2016, Canadian equity performance stagnated in the first half of 2017, with the S&P TSX Index returning 0.7%, lagging both US and international equity markets. This underperformance is primarily explained by the reduced appeal of the largest sectors of the Canadian market, with a difficult half-year for the resources sector — particularly oil which continues to struggle with excess supply — and for banks, in the second quarter, given increased uncertainties related to residential real estate.

In the United States, S&P 500 returns in the first half of 2017 were strong in local currency (9.3%) and also very respectable in Canadian dollars (5.4%), despite the Greenback losing 3.6% versus the loonie. A notable fact is that about one-third of the S&P 500's return is explained by the strong performance of only five technology stocks (Amazon, Apple, Alphabet, Facebook and Microsoft) over this period.

For Canadian-domiciled investors, diversification was beneficial as the largest domestic sectors were among the worst performers and returns on foreign equities surpassed those of Canadian equities. Moreover, the two best performing sectors south of the border were health care and technology, which are rather marginal sectors here in Canada.

On the fixed income side, bonds started the year strong although the tide turned in the second quarter. Nonetheless, overall the Canadian bond market returned a respectable 2.4% in the first half of 2017.

The economy

Global economic growth is improving and performance is not solely attributable to the United States, as economic data is now also improving elsewhere as well — Europe, Asia and Latin America.

In the United States, the unemployment rate is at its lowest level in the last 15 years. The strength of the job market is contributing to wage growth, which bodes well for consumer spending.

As for Canada, growth is mainly attributable to consumer spending, housing starts and higher business investments.

Risks — Mostly a question of politics and policy-making

At this stage, as long as the economy continues to perform well and interest rates remain at relatively low levels, risks will be primarily political in nature.

"POPULIST" POLICIES

The current US government has promised a major corporate tax overhaul that would significantly reduce corporate taxes and allow US companies to repatriate cash held in foreign subsidiaries to the United States at a significantly lower tax rate. These favourable measures are already at least partially reflected in the price of securities today. Hence, political decisions that differ significantly from expectations would undoubtedly have an impact on the valuation of securities.

Risks associated with trade policies are also important, as the introduction of tariffs and other protectionist measures that have the potential to constrain trade would increase costs and undermine profitability for firms with global supply chains and distribution networks. OPEC's decision to reduce production has impacted the price of oil — however, prices have remained under pressure as production has shifted elsewhere, notably in the United States.

MONETARY POLICY

A growing economy and a low unemployment rate are factors that favour inflation — central banks will therefore become less accommodative and will gradually raise interest rates. Raising rates too aggressively, however, would negatively impact corporate profits while an overly anemic approach would undoubtedly lead to an increase in the inflation rate. The extent of future rate hikes and their timing throughout various regions around the globe will have an impact on exchange rates.

POLITICAL RISKS — VIOLENCE AND TERRORISM

Globally there will always be numerous sources of potential risk. Some of the risks that have made headlines this year include the unpredictability of the Trump government, North Korea and its atomic weapons, Brexit negotiations and the increased terrorism-related violence in the West. Risks of this nature garner significant media attention, although their impact on stock markets is often short lived.

Investment Strategy

From an investment standpoint, the fact that the economy is doing well and that consumption levels remain healthy are both positives as it should contribute to higher corporate profits. However, generally elevated valuation multiples that reflect these favorable expectations, reduce our enthusiasm and lead us to dedicate more time to finding attractive investment opportunities. Our strategy remains unchanged as the core of our approach continues to rely on the disciplined and rigorous analysis and evaluation of financial results of profitable companies able to pay dividends, with strong balance sheets and attractive valuations metrics. It is this approach that has allowed us to achieve superior returns over the years and we remain convinced that it continues to be the best way to invest over the long term as it allows for a healthy combination of prudence and performance.

Author(s)