The Real Value of ESG Investing

What is ESG investing?

Environmental, Social and Governance (ESG) investing can be summarized as an additional set of considerations prior to investment decision-making. Namely, asset managers aim to incorporate both a company’s fnancial returns as well as their social, environmental and governance impact on society to better manage risk and generate sustainable, long-term returns.

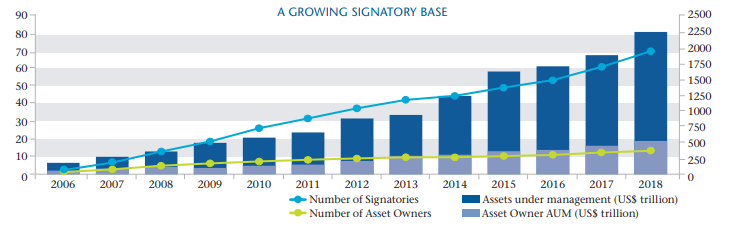

The ESG approach has become increasingly popular over the years. In fact, according to the United Nations who support the Principles for Responsible Investing (PRI), over 2,000 signatories representing $80 trillion in assets under management now vow to adhere to these principles.

What is the debate about?

Along with the ever-growing interest in ESG investing, a debate has sprouted around potential performance issues. The basic argument suggests that aligning investment decision-making with ESG considerations must mean giving up potential returns. Implementation costs, industry exclusions, company exclusions, and other factors limiting the opportunity set must weigh down expected returns, not to mention the company-specific costs related to best practices in all three ESG spheres. For example, engaging with a team of experts to implement, monitor and make recommendations regarding corporate CO2 emissions would prove costly and ultimately weigh down corporate profits.

What does the research show?

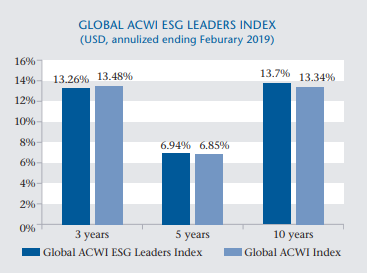

Countering these performance claims are numerous studies demonstrating that the use of ESG principles by both companies and investors alike has a tendency to enhance long-term performance. The reason explaining these findings is that incorporating ESG factors is a viable means to reduce risks, which are costly to contain and minimize once problems materialize. There is a significant mutual benefit from risk reduction at the corporate level and, by extension, at the investor level as well. Both are highly averse to underperformance due to company-specific risks, thus mitigating these risks should have a positive impact on financial outcomes and long-term results.

A recent research study conducted by a leading global index firm1, concluded that companies with high ESG ratings tend to have more resilient cash flows and better return metrics than peers, thus leading to higher profitability and dividends over time. This same study also showed that these companies tend to be better at effectively managing company, business and operational risks, thereby lowering the probability of being negatively impacted by unforeseen incidents that could adversely effect their share price. Furthermore, the study concluded that companies with high ESG standards tend to have lower market risk exposure which has a positive impact on their cost of capital and profitability versus their peers.

What are the long-term benefits?

A growing body of evidence appears to suggest that companies focused on implementing ESG principles are more likely to reap added rewards in the future and may even avoid certain meaningful risks that could be detrimental to a company’s survival. As companies continue to take a more proactive approach to tracking and reporting ESG related data, investors are better able to assess their impact on corporate performance. Although there is no one size fits all approach to ESG investing, further confirmation of its benefits should continue to lead to a broader adoption within portfolio management strategies. In the end, taking ESG principles into account in one’s investment approach should allow for better informed investment decisions and consequently better overall investment returns over the long-run.

Why did Allard, Allard & Associés becom a PRI signatory?

The integrity and investment philosophy of our firm is intrinsically aligned with the principles of ESG investing. We focus on investing in profitable companies with high quality balance sheets that generate sufficient cash flows to pay dividends and reinvest in their business in order to ensure long-term prosperity. This approach allows us to focus on quality companies with attractive valuations who engage in best practices from an ESG perspective. Integral to our risk management process is ensuring we have an in-depth understanding of the companies we invest in. As such, integrating ESG factors into our security selection process allows us to more effectively manage the overall risk of our investment portfolios.

Author(s)