Allard, Allard & Associés Turned 25

During the pandemic, our firm turned 25. Even though the lockdown rules have prevented us from celebrating with the people who have contributed to the success of our firm since its creation, the anniversary still deserves to be highlighted.

25 years ago...

Twenty-five years seems like it was yesterday and yet many things have changed. To put things into the context at the launch of the firm in 1995:

Quebec held its second referendum on sovereignty. The prime ministers of Quebec and Canada were Jacques Parizeau and Jean Chrétien.

The Nordiques played their last game in Quebec City before moving to Colorado.

The DVD was released, and Disney's Toy Story was first at the Box Office.

The 5-year mortgage rate was 8.95%

The TSE 300 (now the S&P TSX) was at 4,200 (it is now over 20,000)

Royal Dutch Shell, GE, Exxon, Coca-Cola and Toyota were the 5 largest companies in the world with an average market capitalization of around US$ 100B Today Apple, Microsoft, Amazon, Alphabet (Google) and Facebook sit at the top with market capitalizations on average 17.5x larger.

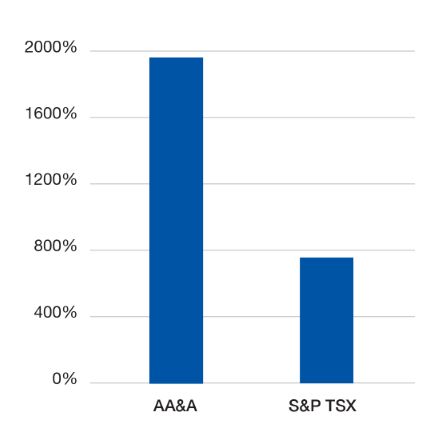

History

The performance history of our Canadian equity strategy goes back to our very beginnings on July 1, 1995. Since its launch, its annualized return has been 12.2%, an excess of 3.7% per year compared to the 8.5% generated by the S&P TSX, the leading index of the Canadian stock market. This return is even more impressive when you look at the total return on our Canadian equity strategy since its inception, which stands at 1910% compared to 735% for the S&P TSX over the same period.

Staying the course

While the long-term results have been very attractive, stock market investment can be a bumpy road and there have been significant periods of volatility over the past 25 years as shown in the accompanying chart.

We have maintained our belief that profitable, high-cash-flow-generating and well-capitalized companies purchased at an attractive price can generate superior and sustainable returns to their shareholders in the long term. A logical approach, fact-based, that has served our clients as well.

Although our investment philosophy has remained unwavering, the firm has still evolved a lot over the years. The most important change is undoubtedly the growth of the team, now up to 12 people - an experienced team of experts in business valuation, portfolio management, securities analysis, technology, compliance, accounting and operations.

Other notable changes include:

The signing of the United Nations Principles for Responsible Investment (PRI).

The integration of environmental, social and governance (ESG) factors into our analysis.

The deployment of our investment strategies through pooled funds.

The evolution of computer systems and technology that we use daily. Rest assured that, in the coming decades, the firm will maintain its values and philosophy and will continue to evolve and improve.

Getting to know you better to serve you better!

In the coming weeks, you will receive an email from us inviting you to complete a survey. The objective of the survey is to ensure that we fully understand your needs so that we can focus our business initiatives going forward in order to serve you even better. We appreciate and thank you for taking the time to complete it.

Author(s)