The Start of a Great Rotation

Value style rebounds

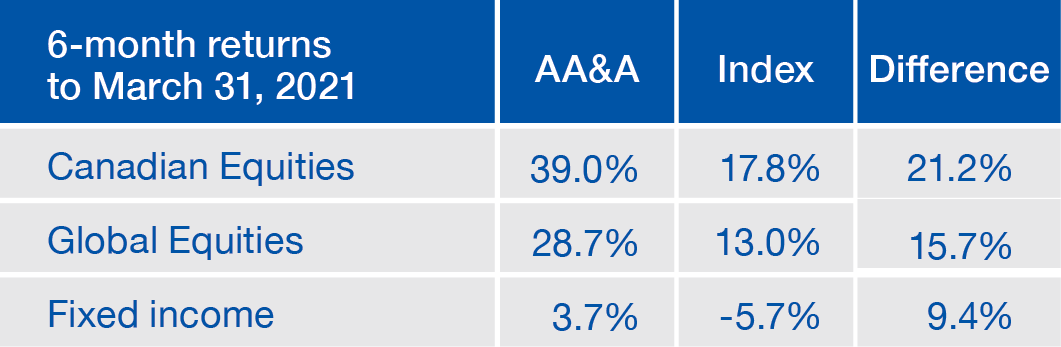

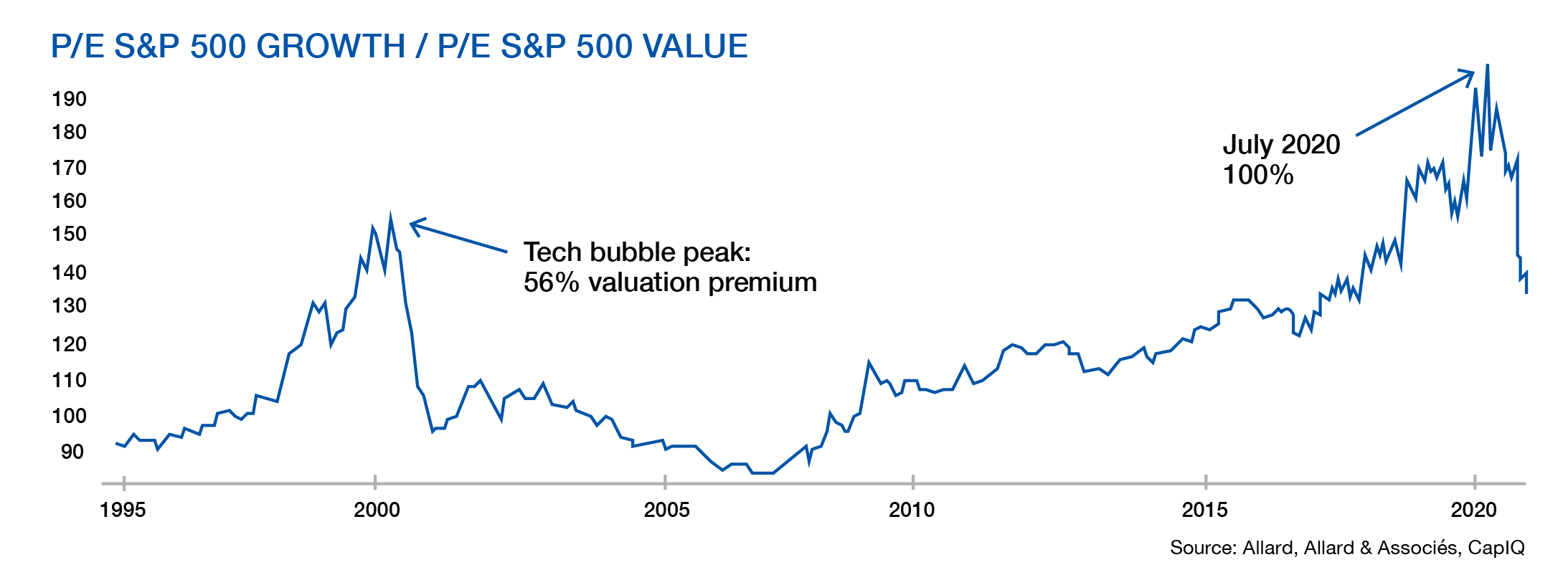

The markets have seen a marked shift in favorable investment styles over the last six months. Since October 1, 2020 global value stock indices have performed better than growth stocks indices (19.3% vs. 6.1% in CAD) overall. Our strategies are well aligned with this shift and have significantly outperformed over the past half-year.

Favorable trends to continue for the value approach

Following such a strong rebound, it's natural to wonder what to expect next. Historically, after recessions, the value style has experienced a period of strong outperformance.

This can be explained by improved profitability for manufacturing companies which, after rationalising their costs, see their profit margins increase. The outperformance is also explained by investors who, following a period of relative speculation, start paying more emphasis on financial results and valuation multiples. Here are the main tail winds that should favor our strategy over the mid-term.

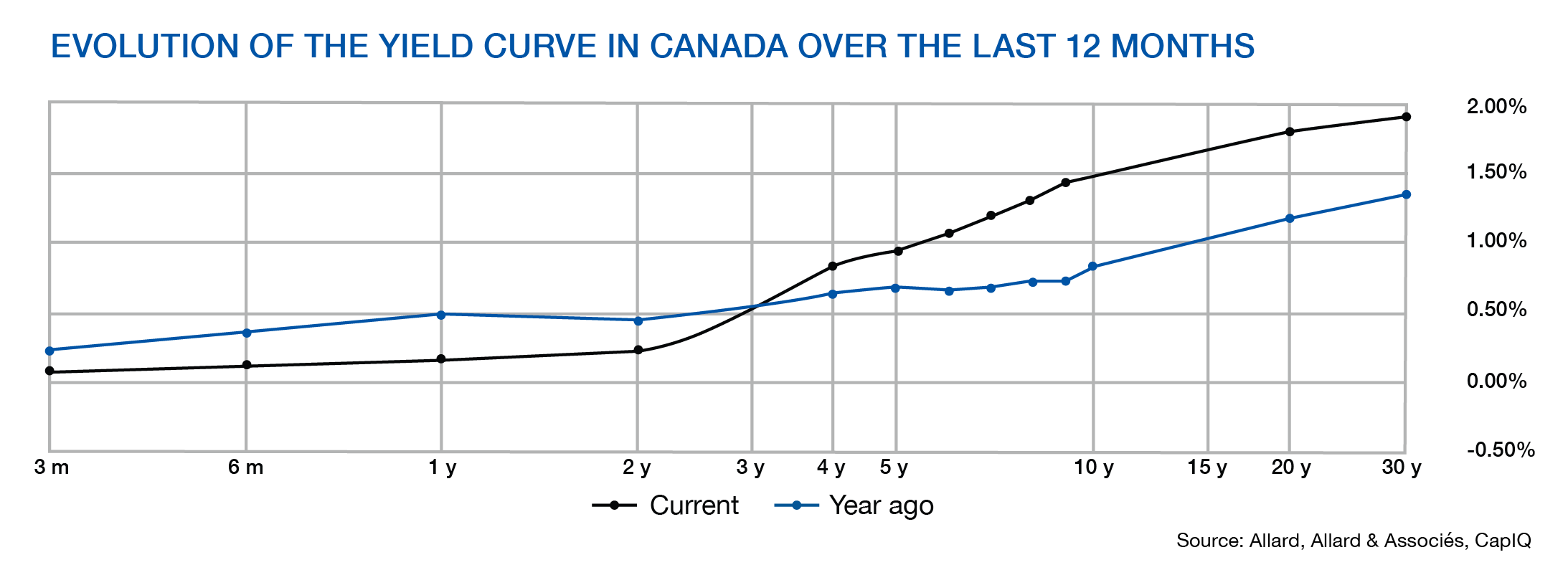

Interest Rates: Interest rates are on an uptrend. Rates on 30-year Canada bonds rose from 1.25% to 1.95%, an increase of over 50% while rates on 10-year bonds have more than doubled, as shown below. These higher rates favor financial sector stocks such as banks and insurers, predominantly seen as value stocks, and disadvantage growth stocks with expected profits in the distant future.

This is because a company is worth the present value of its future profits, in theory. The higher the rates, the lower the value is given to those future profits in today's dollars, hence the unfavorable impact of a rate increase on the price of growth companies such as the typical technology stock.

Basic resources / infrastructure: Economic recoveries coincide with increased demand for natural resources driven by a resumption in manufacturing activity as well as major infrastructure projects such as the infrastructure plan recently announced by President Biden. This will favor industrial companies as well as those with exposure to raw materials and energy.

Reopening: The theme of post-Covid-19 reopening should continue to gain momentum over the working from home theme. With the vaccination campaign and its resulting collective immunity, life will gradually resume its normal course and consumer-related stocks, battered by the pandemic, will see their profitability improve and increasingly attract investors.

Normalisation of valuation spreads: Although the valuation spreads between growth stocks and value stocks have narrowed in recent months, they remain well above their historical average. We expect the multiples on value stocks to further improve relative to their growth counterpart as the recent strong performance of value stocks, supported by the previous outlined themes, generates more enthusiasm (see graph above.

Since their launch in October 2019, the Allard, Allard & associés funds have all outperformed their benchmarks.

Did you know that ?

Since their launch in October 2019, the Allard, Allard & associés funds have all outperformed their benchmarks.

Please do not hesitate to contact us should you require more information or to discuss if this solution is appropriate for you.

Author(s)