To include an RRSP contribution in your 2024 tax return, it must be made by March 3, 2025. The maximum RRSP contribution is 18% of earned income, up to $31,560 for 2024 and $32,490 for 2025.

For your TFSA, the contribution limit remains $7,000 for 2025. This brings the total TFSA contribution room since its inception to $102,000, assuming you were at least 18 years old in 2009 and have remained a Canadian resident since then.

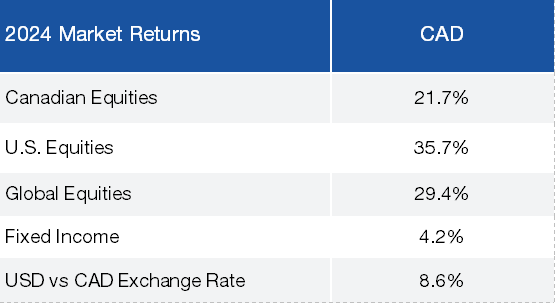

Let’s start with the obvious—2024 was an exceptionally strong year for stock market investors, with global equities delivering an impressive return of 29.4%.

Several key themes drove this market surge:

The "Magnificent Seven" continued to push the stock market to unprecedented heights. With a compounded return of around 50%, these seven stocks outperformed the remaining 493 companies in the S&P 500—the flagship U.S. stock index—by a factor of five. This surge was largely fuelled by the expansion of multiples: at the start of the year, these stocks traded at an average of 65 times normalized earnings, but by year-end, their multiples had risen to 80 times.

The era of high interest rates designed to combat inflation risks appears to be behind us. In 2024, the Bank of Canada and the U.S. Federal Reserve lowered their key rates by 1.75% and 1%, respectively. Lower interest rates benefit equities by improving corporate profit margins and increasing the present value of future earnings.

Historically, gold prices have moved in step with inflation. In 2024, the price of gold (in U.S. dollars per ounce) jumped by 30%. This increase had an even greater impact in Canada, given the country’s significant exposure to commodities.

We speak of extremes, as on the one hand, safe-haven assets like gold saw surging demand due to geopolitical tensions, including ongoing armed conflicts, trade disputes, and cybersecurity threats. On the other hand, optimism surrounding technological innovation fuelled risk-taking in equity markets.

The U.S. dollar, another safe-haven asset, performed strongly against other currencies—gaining 8.6% against the Canadian dollar in 2024. Meanwhile, Bitcoin skyrocketed by 120%, driven by Donald Trump’s pro-crypto stance and regulatory changes allowing the distribution of exchange-traded funds (ETFs), making Bitcoin more accessible to investors.

RETURNS ON MAJOR ASSET CLASSES (CAD)

In short, 2024 was a year in which market sentiment and perception played a larger role in returns than actual financial fundamentals.

The risks of recession causing major concern a year ago have significantly diminished. The probability of a recession over the next two years is now very low.

The dominant theme of 2025 is likely to be geopolitical tensions. Behind the curtain, there will be a focus on the uncertainty caused by the disruptive impact of a second Trump presidency, particularly on immigration and trade. One of the contradictions of his campaign is that he heavily criticized the previous administration for rising inflation, yet his protectionist stance—prioritizing trade barriers over free markets—will inevitably drive prices higher for consumers.

Overall, markets appear richly valued. However, when excluding AI-driven stocks, the rest of the U.S. market, as well as the Canadian and international markets, are trading at far more reasonable valuation multiples.

Allard, Allard & Associés celebrates its 30th anniversary this year. As we enter our fourth decade of portfolio management—serving, in some cases, third-generation clients—we remain committed to the philosophy we established in 1995: delivering high-performing, prudent, and sustainable portfolios by maintaining a long-term vision and focusing on tangible financial results rather than passing trends or speculative promises.

This disciplined approach has served us well over the long run, as demonstrated by our strong performance over the past 30 years. In the short term, we have sometimes underperformed benchmark indices—such as in 2024, when markets exhibited irrational behaviour. However, in the end, sound principles always prevail. We firmly believe that our strategy of investing in financially strong, profitable companies at reasonable prices will continue to generate superior returns over full market cycles.