A speculative bubble is defined as a significant, growing, and persistent gap between the price of an asset and its intrinsic value. This gap is fueled by the belief that the asset's price will continue to rise in the future, rather than by its actual worth.

The most famous example of a speculative bubble is that of “Tulipomania” in the 17th century. When tulips were introduced to Western Europe, the Dutch, who were passionate about flowers, established a hierarchy of tulip varieties based on the species and color. According to this hierarchy, values were assigned to the different flowers. However, as it was impossible to determine what bloom would result from a particular bulb, tulips quickly became objects of speculation. At its peak, before the 1637 bloom, tulip bulbs were priced at 20 times the annual salary of a skilled craftsman. This level of irrationality was unsustainable, and when prices inevitably collapsed, thousands of families were ruined, and the Dutch economy took decades to recover.

Many bubbles have come and gone since the tulip bubble, the most recent being the real estate bubble in various Western countries, which led to the credit crisis of 2008, and the tech bubble at the turn of the millennium, which burst in 2001.

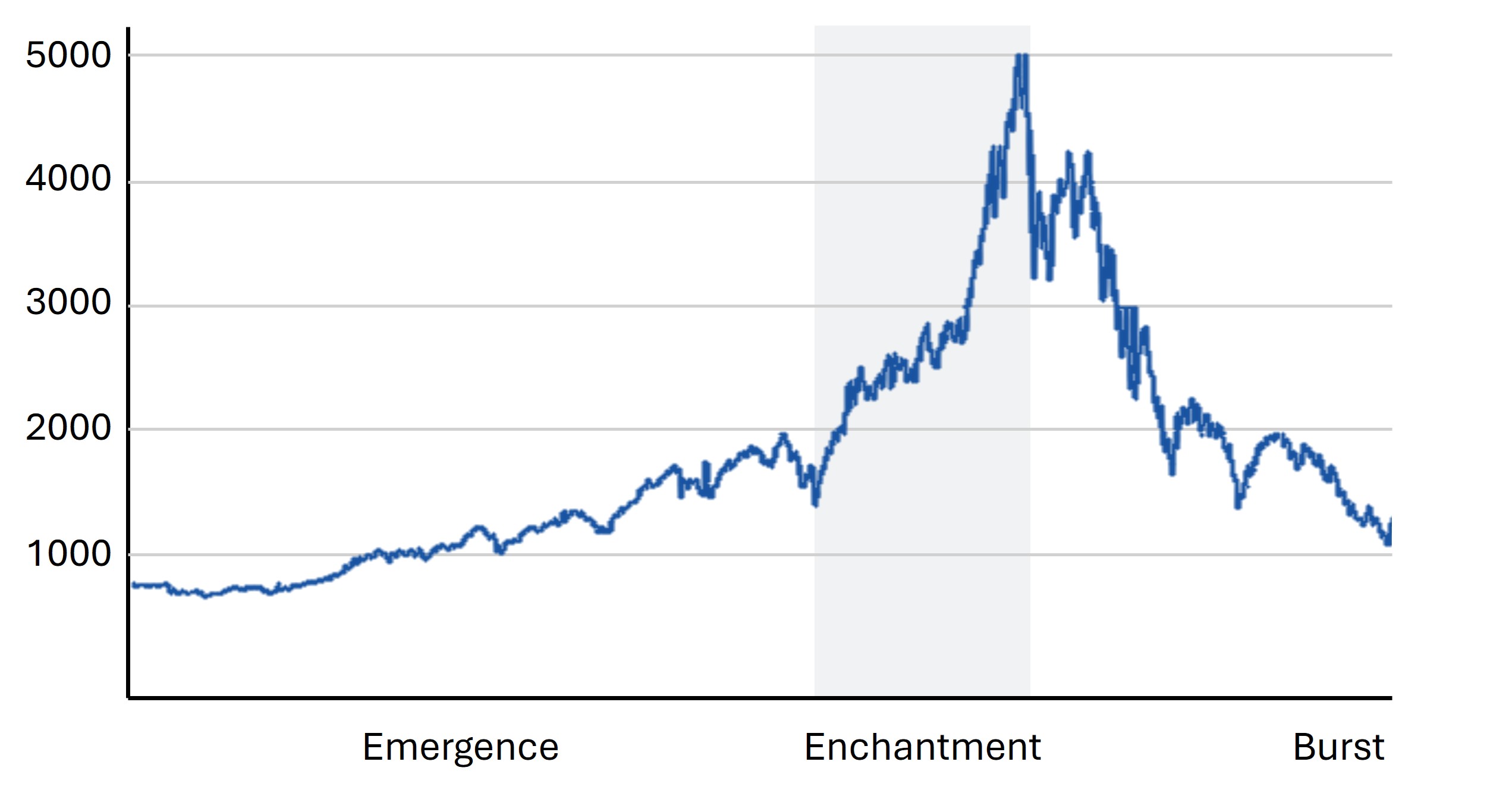

NASDAQ DURING THE TECH BUBBLE OF THE 1990s

Source: Bloomberg

Even more recently in Canada there was the cannabis bubble, linked to its legalization in October 2018. The best-known cannabis stock involved was Canopy Growth, which at its peak was trading at $737.50 (adjusted for the 10-for-one merger in Dec. 2023) compared to roughly $9 at the time of writing in August 2024 - a decline of 99%.

The Emergence

Speculative cycles arise from systematic forecasting errors, i.e., the overestimation of future returns and the underestimation of the risks associated with them. These valuation errors are often accompanied by an external shock, either the start or end of a war, or an innovation that suggests that conventional valuation methods no longer apply. Thus, the formation of a speculative bubble stems from the fact that an erroneous conception is massively adopted, and the irrationality underlying it is temporarily perceived as the truth. Easy, affordable access to credit typically plays an aggravating role in bubbles.

The Enchantment Phase

The bubble’s inflation is fueled by the interaction between those who fervently believe in a new paradigm and those who remain skeptical but, driven by greed, attempt to participate in the rising market, thinking they can exit in time. This speculative phase is supported by a myth about the asset in question that captures the investor’s imagination and creates a disconnect between rationality (emphasis on income, economic value) and irrationality (emphasis on potential capital gains). Indeed, the entry of the masses, attracted by exaggerated enrichment prospects echoed in the press and by word of mouth, accelerates and fuels the soaring asset prices that underpin the bubble.

The Burst

As prices soar and disconnect from all reality, the more rational investors soon recognize the situation and begin to crystallize their gains, even though the trend can continue for some time.

For a bubble to burst, the euphoria fueled by greed must be replaced by fear. The end is near when the growing number of sellers begins to match the latecomers entering the market, who are unaware that they are acquiring "hot potatoes." Then comes the inevitable, when an unforeseen event causes a radical shift in sentiment, and incipient fear gives way to panic. The more realistic investors start to sell to the point where sales far outweigh purchases. The resulting fall in prices only accelerates the now irreversible panic—the bubble has burst.

A famous quote by Sir John Templeton aptly sums up the role of emotions on financial asset prices: "Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria."

In 1720, after the crash of South Sea Company shares, the most famous bubble in the United Kingdom, Isaac Newton was asked what he thought of the matter. He replied, "I can calculate the motions of heavenly bodies, but not the madness of people."

Human nature drives many to seek quick results with little effort. Therefore, many will likely continue to adopt irrational behaviors in everyday life, such as buying lottery tickets, participating in pyramid schemes, purchasing miracle pills, or consulting their horoscopes. Since investors are, first and foremost, human beings, financial decisions are not immune to human folly. Consequently, so long as the irrational behaviors (herd mentality, overconfidence, confirmation bias, etc.) studied in behavioral finance persist, the risk of speculative bubbles will remain.

Following the tech bubble at the turn of the millennium and the more recent credit bubble, which dominated financial press headlines, many investors have wondered what could have been done to protect their capital.

All indications suggest that the current enthusiasm for new technologies, particularly artificial intelligence, gives the appearance of a bubble in its enchantment phase. Only time will tell, as the existence of a speculative bubble is generally only confirmed after it collapses.

For an investor, using a rational approach based on proven analysis methods, common sense, and a diversified investment portfolio is undoubtedly the best way to avoid, or at least minimize the downsides of a bursting speculative bubble.

At Allard, Allard & Associés, we invest our efforts in identifying, evaluating, and purchasing quality companies at reasonable prices, with a long-term vision—just as a business owner would. As was the case at the turn of the millennium and with cannabis stocks, we remain confident that our rigorous, disciplined, rational, and diligent approach will help mitigate both the euphoria of the enchantment phase and the pain of the next speculative bubble bursts. This approach is what typically allows us to perform better during bear markets. (See https://www.allard-allard.ca/en/publications/the-benefits-of-a-low-capture-of-market-declines)