To help first-time home buyers save for a down payment.

For adults, Canadian residents, who are between the ages of 18 and 71 and who have not owned a home in the last four calendar years.

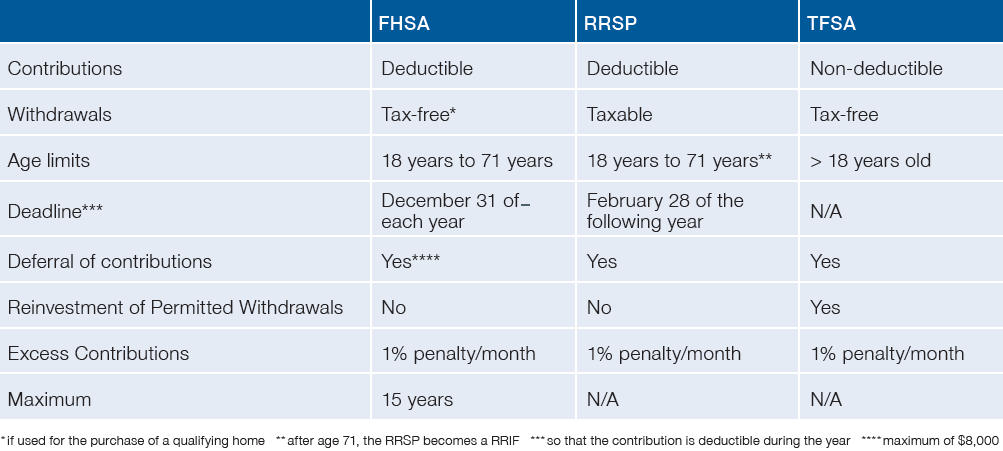

Like the TFSA, the money invested in this account and the returns it generates will never be taxed if they are withdrawn to purchase a qualifying home.

Unlike a TFSA and like an RRSP, the amounts invested in the FHSA are tax-deductible.

Thus, the FHSA allows you to acquire a qualifying residence by paying for a portion of it with gross money (before taxes).

You can contribute a maximum of $8,000 per year, subject to a lifetime limit of $40,000.

$8,000 of unused contribution room can be carried forward into the future.

To be eligible, a home must be located in Canada.

The lifespan of the FHSA is limited. The closure of your FHSA account must take place no later than December 31 of the year of the first of these occurrences:

The account will have celebrated its 15th anniversary;

You will have reached 71 years of age;

You will have made a qualifying withdrawal.

DIFFERENCES AND SIMILARITIES OF THE RRSP AND FHSA

The HBP allows you to "borrow" from your RRSP to buy your first home. You do not pay tax when withdrawing. However, you must repay your RRSP in subsequent years. Deposits made to your RRSP as part of the HBP repayment are not deductible.

Since the withdrawal from the FHSA is tax-free, we prefer this program to the HBP. The two programs can be combined.

Eligible investments are the same as RRSPs and TFSAs (CRA Folio S3-F10-C1), including: publicly traded stocks, fixed income, mutual funds, etc.

While the same investment tools are available, the FHSA’s investment horizon will likely be different from that of your TFSA or RRSP, which means that its content will likely need to be different as well. Your advisors at Allard, Allard & Associates will be happy to recommend what is optimal for you.

Unused amounts from the FHSA can be transferred to an RRSP before it closes or withdrawn. If the withdrawal option is chosen, the amounts withdrawn will be added to your taxable income in the year of withdrawal.

In our opinion, the FHSA is an amazing tool for anyone who has not owned a home in the last 4 calendar years and has employment income, regardless of whether they intend to buy a home or not.