Changes to the Tax Treatment of Capital Gains

The capital gain tax inclusion rate is set to increase for the first time in 34 years, a reform that will impact corporations and individuals holding taxable accounts.

On April 16, Finance Minister Chrystia Freeland presented the new federal budget for 2024. In an effort to reduce the deficit, she announced measures affecting the taxation of capital gains, effective June 25.

First, what is capital gain?

Capital gain is the difference between the acquisition cost of an asset and its sale price. The capital gain becomes taxable only once it has been realized: i.e., once the asset has been sold.

Unrealized gains reflect the appreciation in value of your investments that have not been sold.

What is the proposed change?

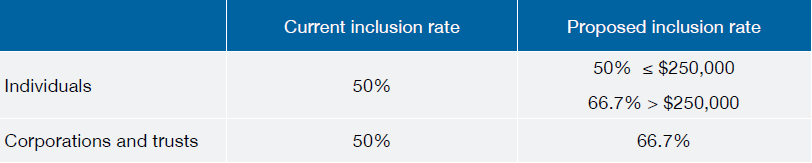

Since 2000, the inclusion rate, or the portion of the capital gain that is taxable, has been set at 50%. Simply put, 50% of realized gains are taxable at your marginal rate, while the difference (the other 50%) is not taxable.

The proposal outlined in the 2024 budget calls for an increase in the inclusion rate to 66.7% for capital gains incurred by corporations and trusts. The inclusion rate for individuals will remain at 50% on the first $250,000 of gains realized in a calendar year, rising to 66.7% for gains exceeding this amount.

What does it mean for you?

It is worth noting that, at the time of writing, the changes have not yet been adopted, although most experts believe they will be. Also, inclusion rates have varied in the past, and may do so again in the future.

Since capital gains taxes could be higher as of June 25, 2024, we recommend that you review your situation QUICKLY to determine whether you should realize any gains prior to this date. In this context, here are the factors that could warrant the realization of gains in your investment accounts before the summer.

For your corporate or trust accounts:

Your accounts have accumulated unrealized gains;

You plan to make withdrawals from these investment accounts in the short/medium term;

You wish to receive a dividend from your Capital Dividend Account (CDA).

For your personal accounts:

Your accounts show unrealized gains well in excess of $250 000 and your health status or other considerations lead you to believe that your investment horizon is relatively short.

SUMMARY OF PROPOSED INCLUSION RATE CHANGES

What should you do?

Should you hold investments in any accounts affected by the upcoming changes, please do not hesitate to contact us. We will be happy to discuss the impact of these changes with you, and work with your tax advisors to implement the appropriate strategy for your situation.

Author(s)