2023 A volatile but positive year

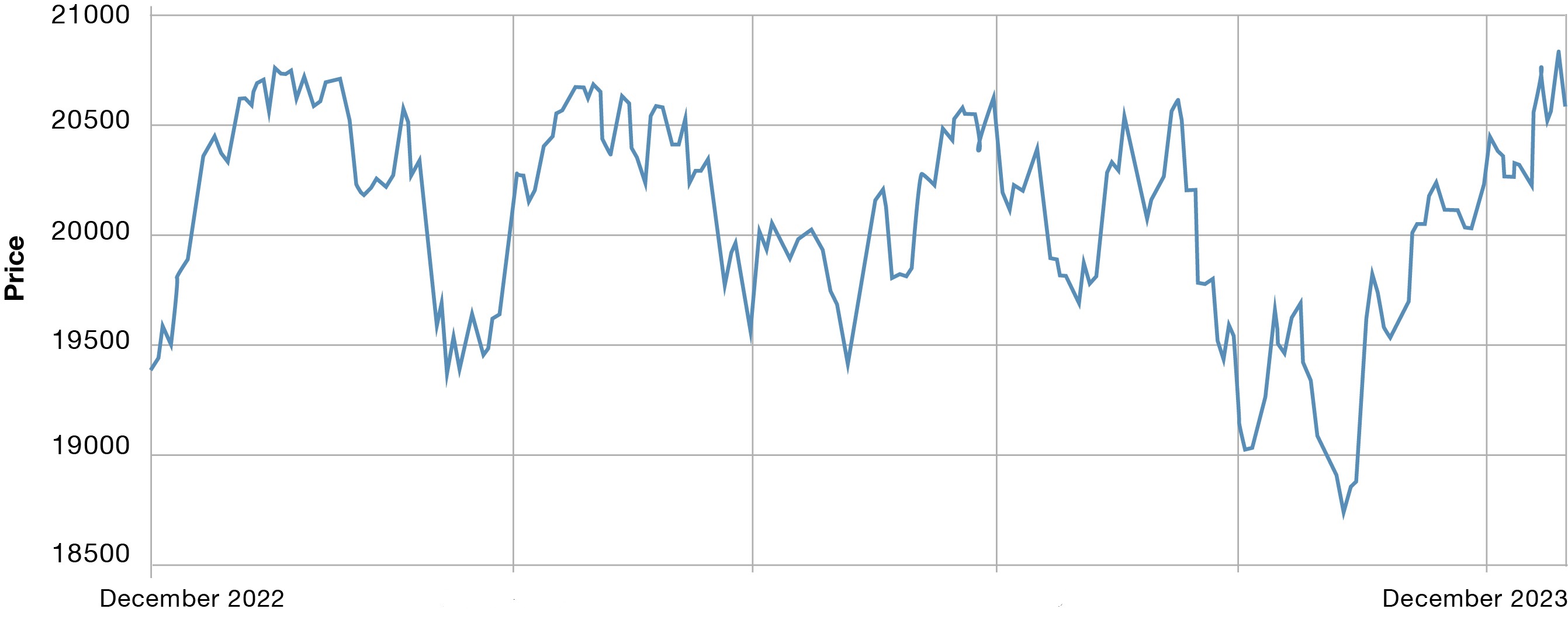

It was a good year for the markets in terms of performance, despite the pessimism of forecasters and the high volatility. Looking at the ups and downs of the chart for the Canadian stock index below, it’s easy to understand how investors sometimes felt like everything was going well while at other times, it was going badly.

CANADIAN EQUITY MARKET IN 2023

The strong rebound in the last quarter of the year will have made 2023 a year of strong returns overall for the markets.

Several factors have marked the past year:

The Emergence of Artificial Intelligence

At the end of 2022, the launch and adoption of generative AI tools, such as ChatGPT, marked the starting point of the current enthusiasm for AI. Since then, everyone has realized that the adoption of AI can have great value for humanity, and as a result, investors are looking to find a way to profit from it.

In 2023, AI set the pace for financial markets primarily through the companies that have come to be known as the "Magnificent Seven" (Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, and Alphabet). These companies alone have contributed more to the performance of the U.S. market over the past year than the other 493 companies in the S&P 500 combined.

Victories for workers

There has been an explosion of labour disputes in 2023 that have often resulted in substantial gains for employees.

Of course, for investors, a higher labour cost typically means that companies will face a squeeze in their profit margins unless they can pass on those increased costs to their customers.

The Rise of Weight Loss Drugs

Drugs such as Ozempic have become the nemesis of obesity. The phenomenon is such that companies are anticipating changes in consumption, particularly in the food sector.

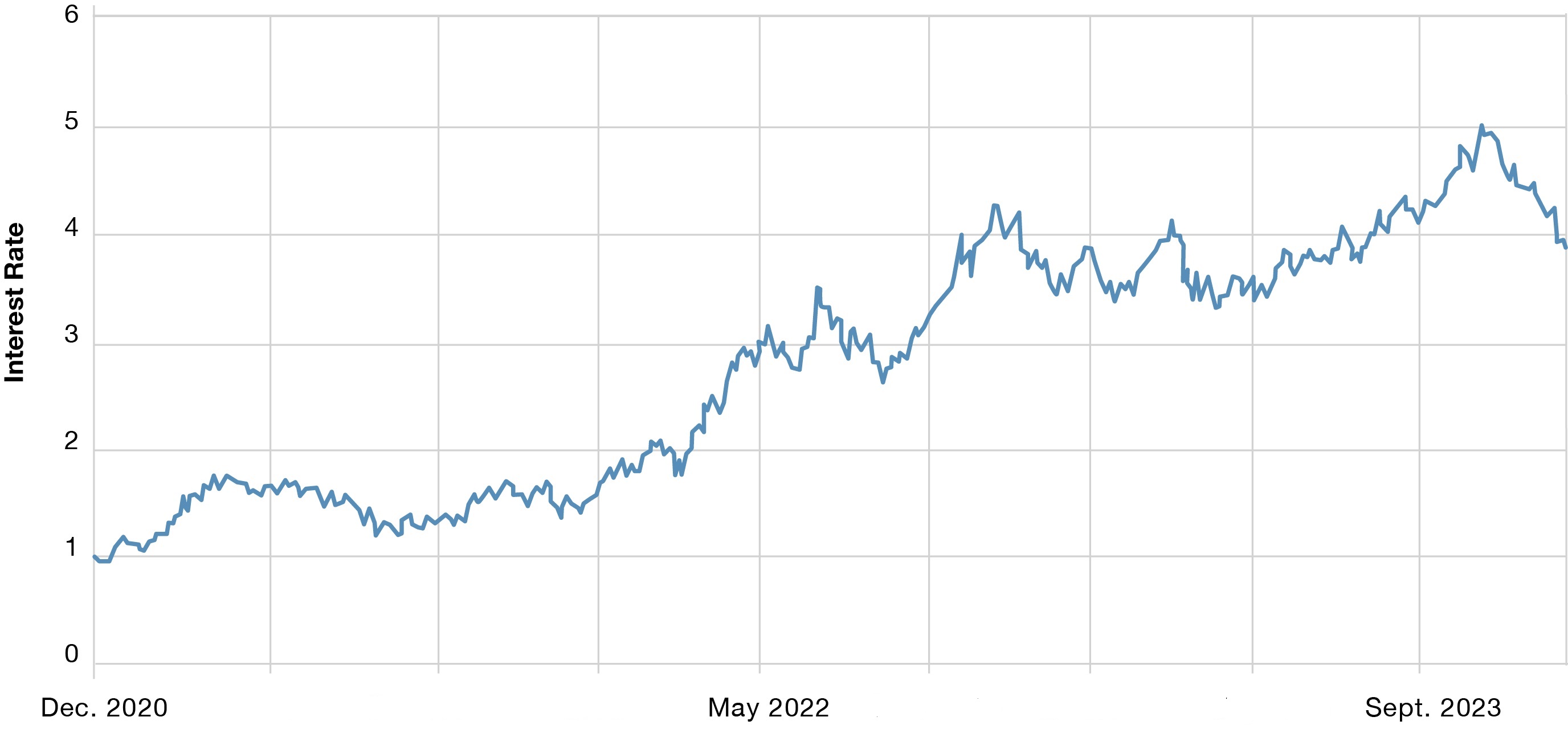

The end of interest rate hikes

Interest rates had been on an upward trend since the pandemic. This trend seems to have come to an end in recent months, as shown in the chart of 10-year US Treasury yields. This trend reversal can mainly be explained by favourable inflation data and a reversal in expectations regarding central banks’ monetary policies for 2024. In other words, an inflection point has been reached after which rate hikes will give way to rate cuts.

10 YEAR US TREASURY BILL

Outlook for 2024

Inflation remains a source of concern for investors, but the evolution of interest rates is encouraging. Central banks around the world are maintaining or cutting rates to stimulate the economy in the face of various headwinds. Canada and Europe are expected to post more modest growth in the first half of the year, followed by a recovery in the second half of the year, as past rate hikes have weighed on corporate profits and household consumption. The situation in the U.S. is a little different, as consumers have been less affected by interest rates as they have taken advantage of setting their mortgages at very low levels. For the stock market, earnings are likely to face challenges as the economy slows, but lower interest rates typically help the equity market overcome this weakness. Our focus on quality and our rigorous valuation methodology allow us to successfully reconcile these two factors and we remain confident in long-term rewards of holding stocks.

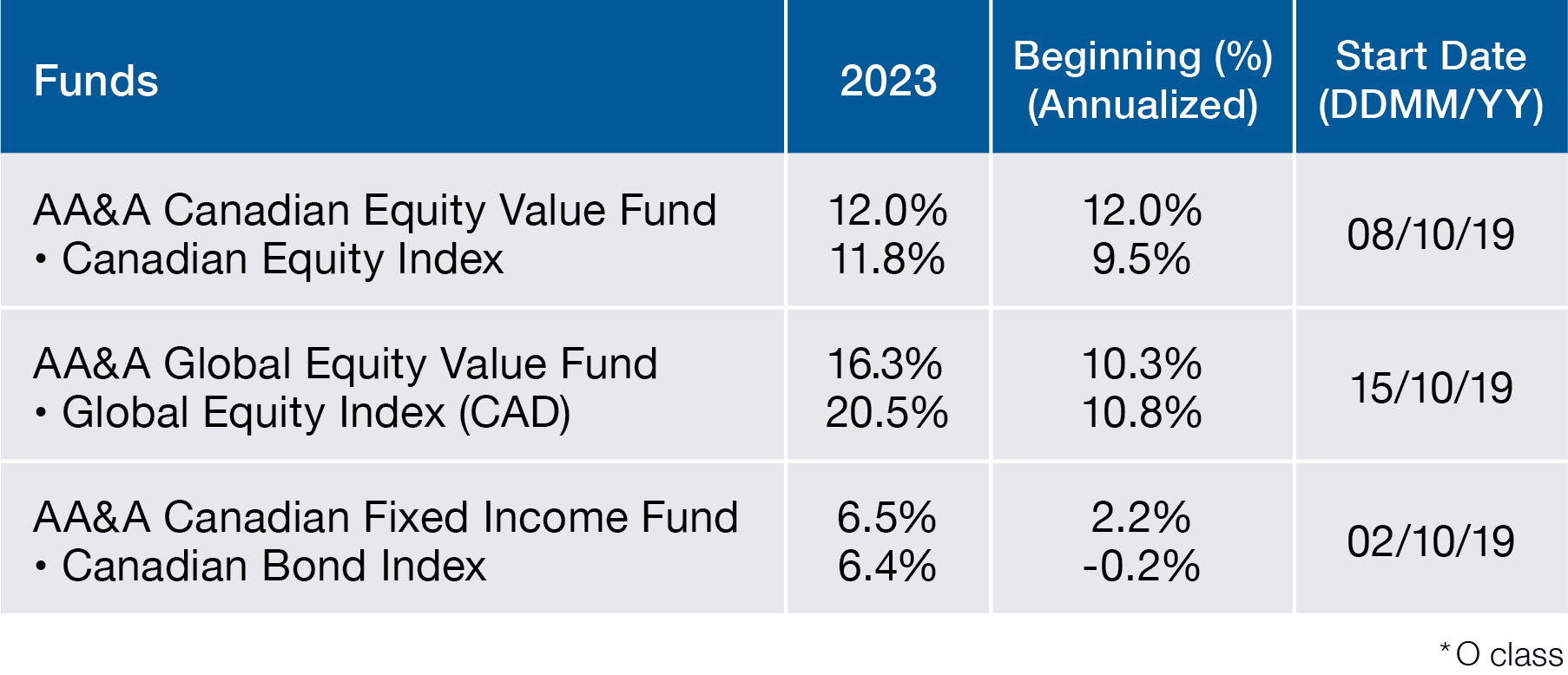

PERFORMANCE OF THE ALLARD, ALLARD & ASSOCIES FUNDS AS AT DECEMBER 31, 2023*

DID YOU KNOW?

To include an RRSP contribution on your 2023 tax return, it must have been made on or before February 29, 2024. The maximum RRSP contribution is 18% of your earned income, up to a maximum of $30,780 for 2023 and $31,560 for 2024.

For your TFSA, in 2024, the contribution limit has been increased to $7,000. As a result, the total TFSA contribution room since its inception is now $95,000 if you were at least 18 years of age in 2009 and have remained a Canadian resident since then.

Author(s)