Market Review - Fourth Quarter 2021

2021 In Review : COVID, supply chains, inflation and strong stock return

2021 was another year of turmoil marked by new COVID variants, disruptions of supply chains and inflation levels never experienced for many investors.

Despite this backdrop, equities had a strong year as Canadian, American, and Global stocks all moved significantly higher on the back of COVID re-opening trade, monetary liquidity and increasing corporate earnings. Businesses have shown great resiliency and corporate earnings have now surpassed their pre-pandemic levels, fueled notably by vigorous fiscal and monetary measures.

As surprising as it may seem, earnings growth was the main contributor to 2021 stock returns. For the US market, earnings increased by 32% last year while valuation multiples contracted by 4%.

However, it is easy to forget that much of the year’s return was really set in the first couple of months and things moved either sideways or down for the rest of the year.

All sectors in the Global market had double-digit positive performance in Canadian dollars with North America outpacing Europe and Asia. Energy, Financials, and Real Estate were strong globally. In Canada, Materials was the only sector with negative performance as the Gold subsector was down –9.6%.

In the fixed income market, we also saw an important move in interest rates during the first 2 months of the year. Then, surprisingly, bonds completely refused to follow the macro-economic playbook; instead of rising as inflation started to take off, interest rates actually declined for the rest of the year.

Outlook

2022 is already being coined as the year of “Transition”:

from a pandemic health environment to an ongoing endemic;

from a V-shaped growth recovery to a normalized economic environment;

from monetary support to restrictive policy environment;

from fiscally subsidized to consumer and business spending;

from a low-rate environment to an inflation led rise in interest rates;

from outperformance of growth stocks to outperformance of value stocks.

Low interest rates, positive earnings and a mixed investor sentiment usually bodes well for the equity markets. Typically, well measured, and telegraphed rate hikes do not tend to be disruptive.

Markets perception of the upcoming transition in the Federal Reserve (FED) policy will be key. Should they perceive that the FED needs to move faster than anticipated due to stronger inflation, than we could see increased nervousness and weakness in the equities markets.

While the overall markets can continue to do well despite the expected increase in interest rates, we do expect to see a shift in performance of the different investment styles and sectors. As interest rates rise, the discount rate that the market uses to value assets rises as well. Therefore, future dollars are worth less than today’s dollar. What this entails is that assets with a long pay-back period (or duration in financial terms) are less attractive. Long-term bonds, growth stocks, utilities etc. can be put in this long duration bucket. Conversely, value stocks and interest sensitive sectors such as financials are expected to outperform in this environment. Since the beginning of the year, this playbook has proven true, with Financials, Energy, and value stocks all outperforming, while the growth stocks of the NASDAQ are down as the 10yr bonds yields have increased 30 basis points.

Did know you that

For the TFSA, since January 1, 2022, your contribution space has increased by $6,000. Therefore, the total TFSA contribution limit since its introduction in 2009 now amounts to $81,500 provided you were 18 years or older in 2009 and that you have remained a Canadian resident since then.

To include an RRSP contribution in your tax return for 2021, it must be made no later than, March 1, 2022. The maximum RRSP contribution is 18% of your pre-tax income, up to $27,830 for 2021 and $29,210 for 2022.

Two weeks into the New Year, our equity strategies are outperforming significantly, posting positive returns while their benchmarks are in negative territories.

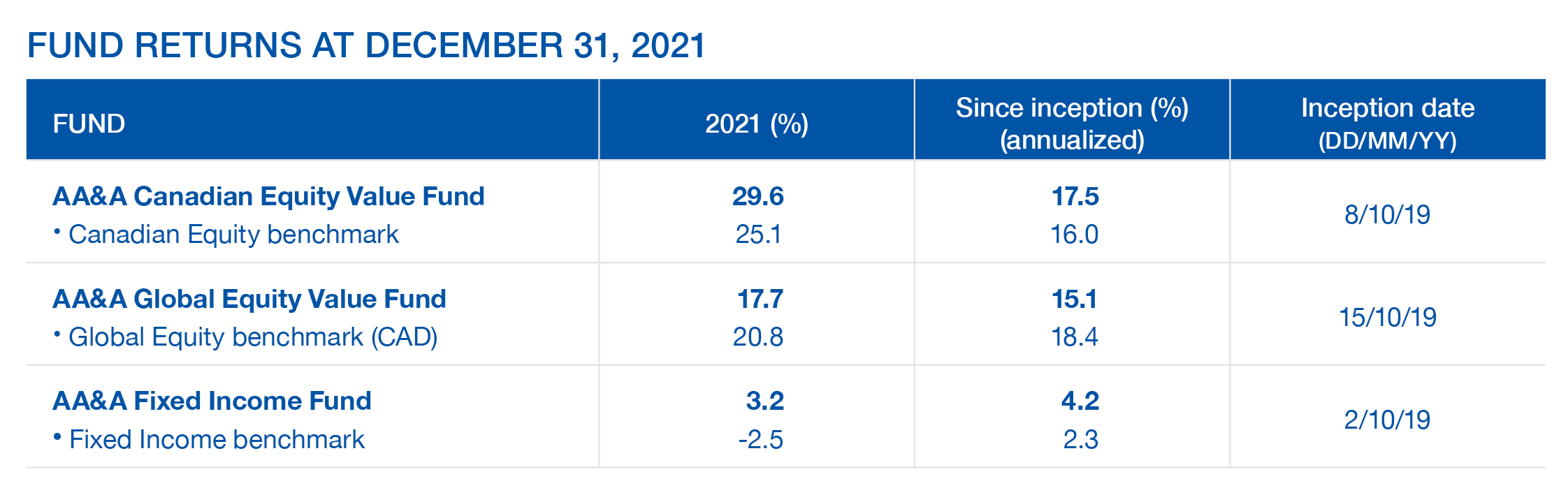

Our funds had strong performance in 2021 and have done well since their inception:

Author(s)