Q3 2023 Market Commentary

Confident, investors entered the third quarter believing that the economy was headed for a soft landing and that a recession this year was unlikely, based largely on the strength of the labour market and consumer spending.

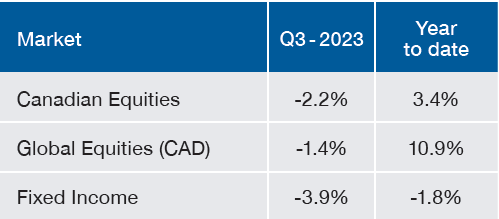

However, during the quarter, expectations in equity and bond markets shifted as the vigorous rate cuts anticipated for 2024 now seem improbable, despite ongoing signs of easing inflationary pressures in the upcoming months.

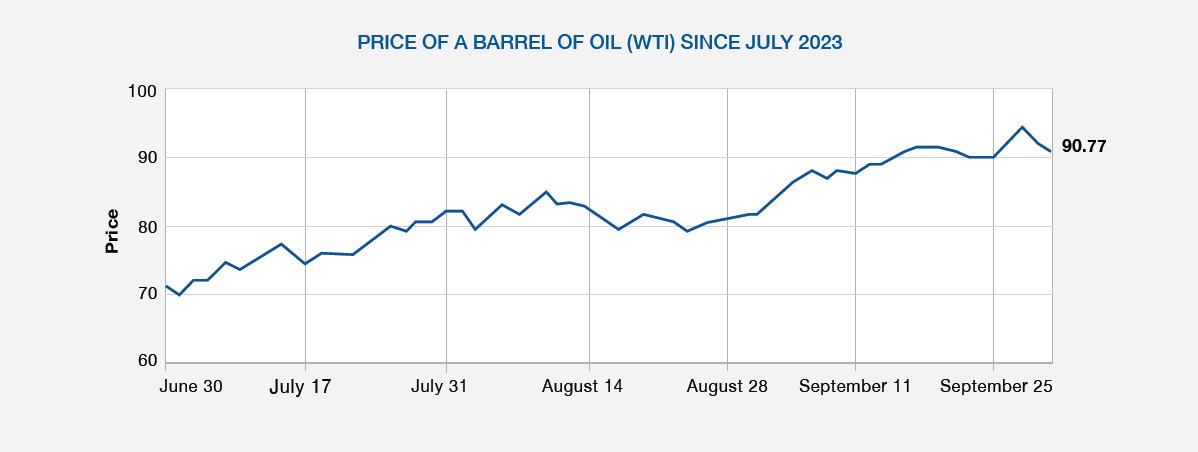

The third quarter also saw a significant increase in oil prices due to production cuts by Russia and Saudi Arabia. As a result, energy stocks outperformed all others, exceeding the second-best sector by over 10 percentage points. It is worth noting that while high oil prices do not alleviate inflationary pressures, they are expected to dampen demand in the long run.

The utilities, real estate, and technology sectors - notably the “Magnificent Seven” - have been the hardest hit by the new interest rate outlook.

Rising interest rates

In addition to the previously discussed matters, the escalating debt of the U.S. government is starting to exert pressure on the economy. The looming uncertainty over the necessity to increase the debt ceiling is a contributing factor. A leading credit rating agency has downgraded the U.S.'s AAA rating to AA+, attributing its decision to the mounting debt and a perceived “erosion of governance”.

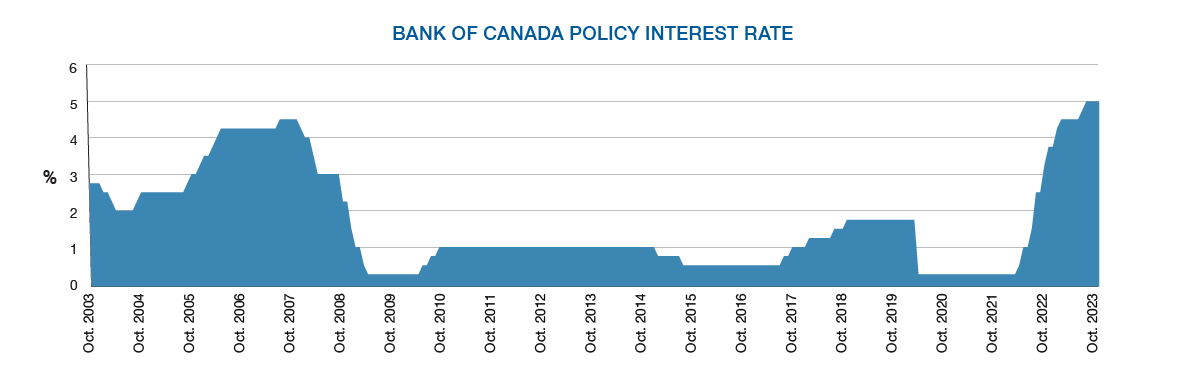

Both the U.S. Federal Reserve (FED) and the Bank of Canada have increased their key interest rates by 0.25% in July, with no changes made in September. Since the commencement of monetary tightening in March 2022, the Fed has elevated its policy rate from 0.25% to 5.50%. Similarly, the Bank of Canada’s rate has risen from 0.25% to 5%.

Against this backdrop of adjusted expectations for higher interest rates, the Canadian bond market fell sharply (-3.9%) in Q3, while long-term bonds (-9.5%) fared much worse than short-term bonds (-0.1%). With its shorter maturities, our fixed income strategy has outperformed its index.

Despite rising U.S. debt and the downgrade of U.S. treasury bonds, the U.S. dollar strengthened against major currencies. This was particularly the case when comparing it to the Loonie, as it appreciated to 1.358 CAD, up 2.6%.

Outlook

As inflation persists longer than anticipated, we can foresee an increase in volatility and a higher probability of a recession. Recessions, which occur on average every six years, are integral parts of economic cycles. Nevertheless, while the principles of capitalism endure, corporations will persist in their efforts to profitably meet consumer needs. The profits thus generated will unfailingly draw capital from investors seeking wealth accumulation.

Despite fluctuations in the economy and equity markets, we maintain our belief in the long-term wealth potential for investors who hold shares in companies with robust balance sheets and reasonable prices. In this context, the current valuation multiples of the securities in our portfolios are highly attractive, with price-to-earnings ratios of less than 15.

Ultimately, stocks serve as a good hedge against inflation since companies are generally able to adjust their prices accordingly. Therefore, remaining invested is a prudent strategy to preserve purchasing power during inflationary periods.

Author(s)