Mid-Year Market Commentary

During the first six months of 2023, several factors have impacted the global economy and stock markets. Rising inflation, stress on the balance sheets of US regional banks, and the rapid development of artificial intelligence were among the most influential factors. We will review each of these elements and then explain how they contributed to the current state of the markets.

Inflation

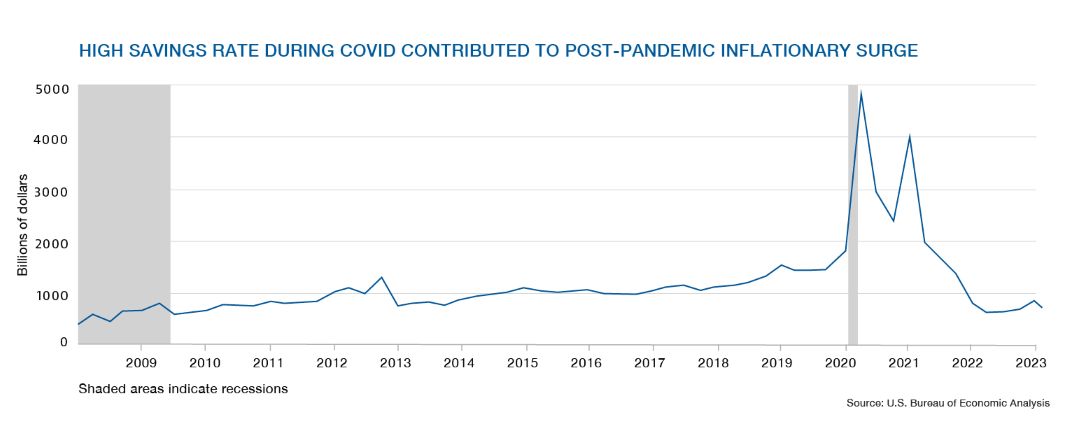

Inflation is characterized by a general and sustained increase in the prices of goods and services. It reduces purchasing power and typically efforts to contain it result in a slowdown in economic growth. Price increases have been vigorous over the past two years, notably due to the recovery of demand following Covid-19 and supply problems (war in Ukraine, China). Although inflation has begun to ease, it remains stronger than desired. According to Statistics Canada data, the annual inflation rate is 3.4% (May 2023) compared to 7.7% a year ago. Recall that the Bank of Canada aims to maintain inflation at 2%, which is the midpoint of its target range between 1% and 3%.

US regional banks

Some US regional banks faced serious liquidity problems during the first half of 2023 as they invested their deposits in long-term bonds. The value of these bonds fell with rising interest rates, and they found themselves in a precarious situation when their depositors began withdrawing funds. US authorities had to act promptly and vigorously to ensure all deposits of troubled banks were secured and avoid a contagious loss of confidence in the entire financial system. The events have tightened credit conditions, making it more difficult to obtain loans and thereby slowing inflationary pressures.

Artificial intelligence (AI)

AI is a field of research that aims to create systems capable of performing tasks normally reserved for humans, such as perception, reasoning, learning, decision-making, or communication (such as ChatGPT). AI has seen tremendous growth in the first six months of 2023 thanks to technological advancements, data availability, and growing demand from businesses and consumers. It is expected that AI will significantly contribute to improving the efficiency, productivity, and competitiveness of companies by optimizing their processes, reducing their costs or increasing their revenues. Investors have recently shown a strong appetite for AI-related company stocks.

Summary of the First Half of 2023

The first months of 2023 were marked by high inflation overall due to the post-pandemic economic recovery. This recovery has pushed up long-term interest rates, leading to a correction in technology stocks. Indeed, investors have tended to favor cyclical sectors such as energy, materials or financials which benefit from stronger growth and improved margins in a context of rising rates.

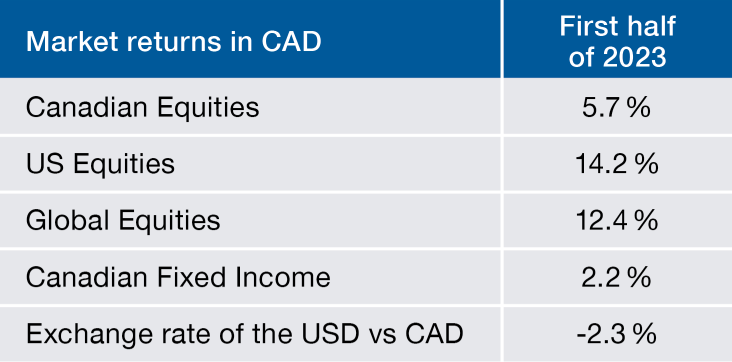

From the second quarter, the trend was completely reversed. In addition to the decline in demand and supply of credit, central banks reassured markets that inflation would be temporary. As a result, long-term interest rates have fallen, which has encouraged a rebound in technology stocks, particularly those related to AI. Foreign markets which are more heavily exposed to technology have outperformed the Canadian market so far in 2023 and the US dollar has edged lower relative to the loonie.

Prospects

Moving beyond 2023, the slowdown in inflation is expected to continue and transition to a more stable period of inflation in subsequent years. In this context, bond returns are expected to remain positive overall, although with rising recession expectations, greater volatility is expected for corporate bonds.

With respect to equities, we are confident that as long as capitalism prevails, companies will continue to make efforts to meet needs profitably, and the profits generated will attract capital from investors who want to enrich themselves. Periods of irrationality can be expected to continue to contribute to stock market volatility. Despite the vagaries of the equity markets, we remain convinced of the long-term enrichment potential for investors who own shares of profitable companies with strong balance sheets and fair prices.

Did you know?

The FHSA is a new registered plan that allows you to save tax-sheltered money to buy your first home. It is expected to be available from our custodians by the last quarter of the year. Please contact us to discuss this if you have not owned a home that was your principal residence in the last four calendar years.

Author(s)