First Quarter Market Review

The equity markets continued their upward trajectory following a robust fourth quarter in 2023. Several benchmarks even set new records in the first quarter of 2024.

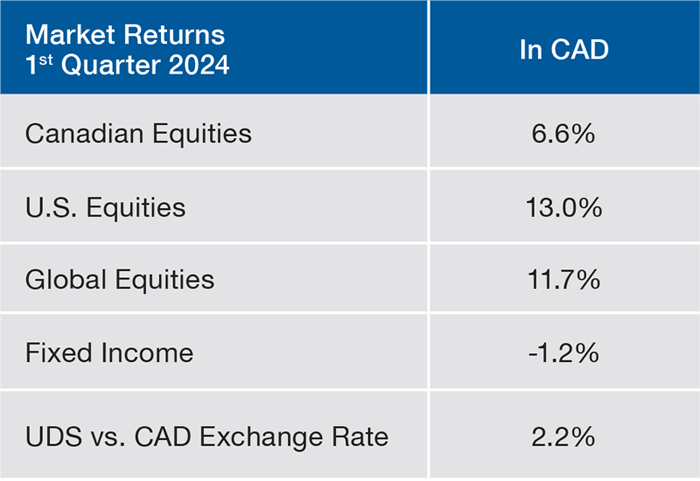

Several benchmarks even set new records in the first quarter of 2024. The Global equity index saw an increase of over 11.7% (in CAD), and the Canadian equity market also experienced significant gains, with an increase of over 6.6% for the quarter. The S&P 500 climbed more than over 13% (in CAD), culminating in a 30% return over the last 12 months, a feat not seen since 2019.

RETURNS ON MAJOR ASSET CLASSES

Entering 2024, investors were buoyed by the prospect of a ’soft landing’ in the US economy, characterized by the avoidance of a recession, easing inflation, and anticipated interest rate reductions by the Federal Reserve starting in March. The US economy’s fourth-quarter GDP exceeded expectations propelled by robust consumer spending, registering a 3.4% increase compared to the forecasted 2%. The Conference Board’s Leading Economic Index (LEI) was positive in March after 23 consecutive months of decline, and the labor market demonstrated resilience. Globally, economic indicators signaled a recovery, with corporate earnings projected to grow by 11% in 2024 and 13% in 2025. These optimistic conditions were mirrored in the adjusted market forecasts for interest rate cuts, with bond futures indicating a rate decrease in June rather than the previously anticipated March, aligning with Federal Reserve expectations.

WEIGHT OF THE TOP 10 STOCKS IN THE S&P 500

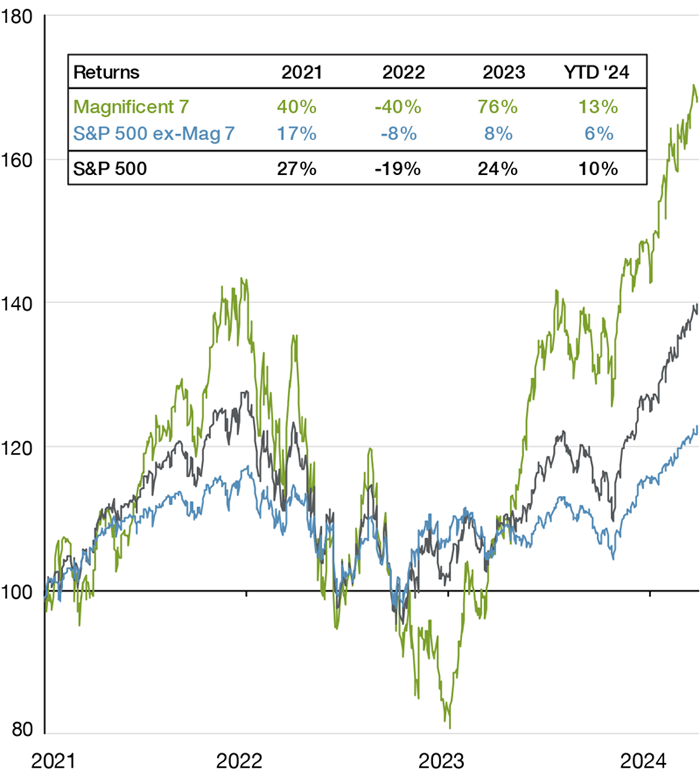

Despite scaled-back projections for Federal Rate reductions in 2024, equity markets maintained their ascent. Somewhat overlooking persistent high inflation and the limited scope of the US market rally, which was largely driven by a select group of AIfocused stocks. As the market continues its climb, there is a growing concern that valuations may be overstretched, notwithstanding the solid double-digit earnings growth. However, investors found stockpicking opportunities beyond big tech companies, indicating a broader market recovery is potentially taking hold.

PERFORMANCE OF “MAGNIFICENT 7” STOCKS IN S&P 500*

Sector-wise, health care and energy were the best performing sectors in Canada, driven by renewed interest in cannabis stocks and a rebound in oil prices. On the other hand, interest-sensitive sectors such as Utilities, Telecom and REITs suffered as the higher-for-longer narrative for interest rates took hold. Globally, communications services and IT were the best performing sectors, driven by the Magnificent Seven. Again, interest-sensitive sectors such as Utilities and Real Estate lagged in performance. Also, notably, several ETFs received authorization from the SEC to include Bitcoin in their holdings. Coupled with a prevailing risk-on sentiment, this development triggered a significant surge in Bitcoin’s value, with its price soaring by 60% over the quarter.

Fixed income experienced less resilience

While the equity markets appeared indifferent to the higher-for-longer narrative surrounding the macro picture and the rate cuts, the bond market displayed less fortitude. The shift in rate cut expectation saw an uptick in bond yields, which in turn precipitated a decline in bond prices and led to poor returns for bond indices.

Outlook

Despite higher valuations, inflation, and rates, there continues to be attractive stock selection opportunities beyond big tech companies. The Federal Reserve’s pause and the outlook for broadening market breadth allow us to be constructive for equities over the next few quarters. As we expect volatility to increase, the current environment calls for a continued disciplined approach around stock picking, with diversification and a focus on balance sheet strength.

Author(s)